The global medical supply chain is not immune to COVID-19

Not all the side effects of COVID-19 are biological. But that doesn’t mean they won’t affect your health anyway.

As global supply chains bow under the weight of the disease because of factory closures in major manufacturing countries like China, the feedback loop is coming full circle—the effects of supply chain disruptions caused by the disease could now also be enabling its spread.

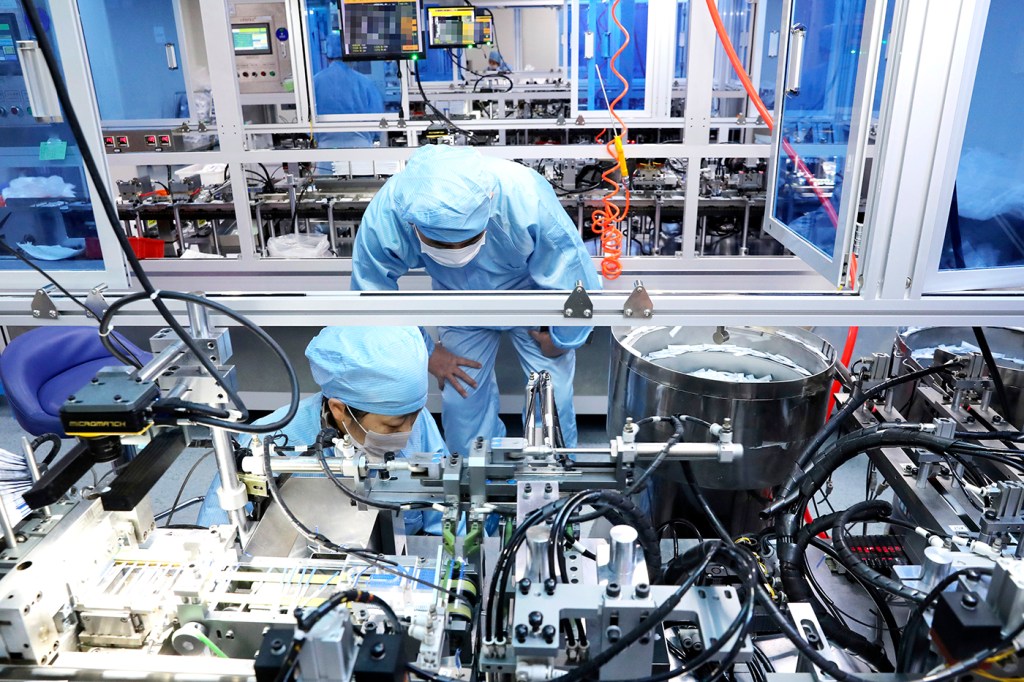

Take masks, for example. Masks help prevent the transmission of COVID-19, which is spread through respiratory droplets produced by sneezes and coughs. China, the country hardest hit by the disease, is also the world’s main supplier of masks.

Nada Sanders Distinguished Professor of Supply Chain ManagementPhoto by Adam Glanzman/Northeastern University

“The U.S. has always relied on China for products like this,” says Nada Sanders, Distinguished Professor of supply chain management at Northeastern. “These aren’t items U.S. companies have wanted to make. They aren’t sexy. They aren’t cool. The profit margins are low.”

But now, mask shortages in the U.S. have become so drastic, the Centers for Disease Control and Prevention have changed guidelines on facial protection for healthcare professionals. Less-protective, loose-fitting surgical masks are now acceptable in lieu of n95 respirators, which block almost all airborne particulars but are in short supply.

“We have no choice, but that’s what’s confusing,” says Sanders. “There are medical guidelines, and we change those based on supply. The CDC is dealing with what they have.”

The same phenomenon applies for hand sanitizer. Traditionally, the U.S. has relied on importing it from other countries, and as global supplies of the disinfectant diminish, major factories in China are ramping up production, but only enough to sustain themselves.

“Manufacturing plants in the auto industry and the tech industry have reconfigured and added some lines of production for things like hand sanitizer and masks for their own use,” says Sanders. “So you see an overlap of these markets and these companies trying to save themselves instead of relying on a diminishing supply.”

“Are we going to be able to do this in the U.S.? I don’t think we’re there yet. We don’t have the capacity, and we’re going to have to start shutting down production,” she says.

As more links in the global supply chain break, Sanders predicts that reserves of certain pharmaceuticals that are manufactured in India but require components from China will also dwindle.

“India is one of the world’s largest exporters of drugs,” Sanders says. “But they rely on components from China, which will affect the production of antibiotics, paracetamol, progesterone, and B12 vitamins. They’ve already started cutting back on exports.”

Some of these drugs, however, are crucial not necessarily for curing COVID-19, but for treating its effects. Paracetamol, for example, is used to reduce fevers, a symptom of COVID-19, and antibiotics, while useless at treating a viral infection like COVID-19, are essential for treating any consequential bacterial infections.

“A lot of people who survive have permanent lung damage and there are secondary infections that come with this,” says Sanders.

Two of the main antibiotics in short supply are tinidazole and erythromycin, which are alternatives to penicillin, an antibiotic that causes allergic reactions in some people, says Sanders.

“Big drug makers in the U.S. say they have several months of supplies,” says Sanders. “But what does that mean? If this continues for another six months, if India and China aren’t able to contain it, we’re in trouble.”

For media inquiries, please contact Jessica Hair at j.hair@northeastern.edu or 617-373-5718.