Multinational companies are seeking to diversify operations because of China’s trade war with the United States, says Northeastern trustee Spencer Fung

For the longest time, Spencer Fung said, analysts questioned the strategy of his family’s century-old business. Li & Fung, which manages an international supply chain for clients in more than 50 countries, refused to invest predominantly in China—even while the economy there was booming in recent years.

Now, with China locked into a trade war with the United States, Fung said that many companies are seeking to follow the example of Li & Fung by diversifying to other countries.

“Because of the U.S.-China relationship, everyone is trying to get out of China,” said Fung, a member of Northeastern’s Board of Trustees and group chief executive officer of Li & Fung.

But the transition isn’t simple. While rival economies may be spared from the billions of dollars in tariffs that President Donald Trump imposed on Chinese products last year, Fung doubted whether the factories in other nations can replicate the high productivity of the Chinese marketplace.

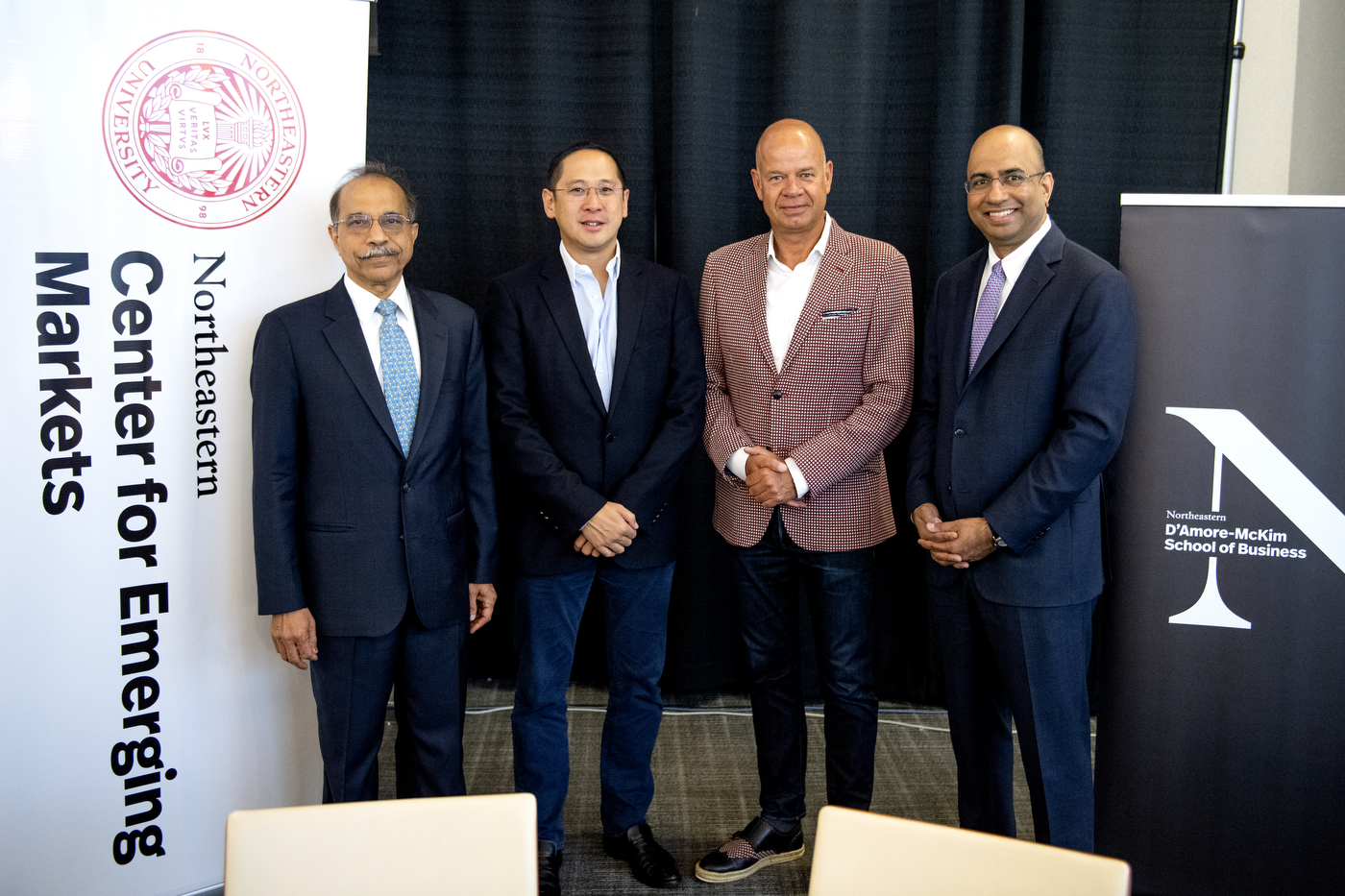

“China is absolutely the factory of the world, because of [its] long history and capability and efficiency—and now technology,” said Fung, the keynote speaker at “Rethinking your China Strategy,” a symposium hosted by The Center for Emerging Markets at the D’Amore-McKim School of Business. In spite of the nascent trade war that threatens to make costs unbearable for many companies, Fung said that China is still “absolutely the most efficient place to produce.”

Trump acted on a variety of long-standing complaints against China—including alleged thievery of American intellectual property—by launching three rounds of tariffs last year, at rates up to 25 percent, on a wide variety of Chinese products valued at more than $250 billion. China responded with tariffs on $110 billion of U.S. exports. Trade talks between the two world powers have failed to end the stalemate, raising global concerns that Trump will make good on his threat of an additional $325 billion of tariffs.

“The trade war is for real,” said Ravi Ramamurti, a University Distinguished Professor of International Business and Strategy at Northeastern and founding director of the Center for Emerging Markets. “Ultimately, how will the global trading system be affected?”

Hong-Kong based Li & Fung, which was started by Spencer Fung’s great-grandfather in 1906, is pursuing what Fung called “the global supply chain of the future” by digitizing and altogether hastening the process of designing, producing, and delivering products.

“What’s happening now between the U.S. and China is the biggest risk that we have seen since 40 years ago,” said Fung, who earned his MBA at Northeastern in 1996. “Because the U.S.-China trade route is the largest in the world, it means that you have to go around this highway. It is uncertain whether this highway will reopen.”

Trump has made the trade relationship with China a centerpiece of his foreign policy. “Trade wars are good, and easy to win,” the president tweeted in March 2018.

“What a lot of our customers have done is to respond to Mr. Trump’s tweets and [changed] their strategy because of that,” Fung said of the short-term responses to news events. “I myself don’t even talk about politics for the time being, because it’s hugely distracting. So what we’re doing now is what we’ve always done: We think five to 10 years out.”

Moving production of goods out of China may result in a reduction in quality, Fung noted.

“China has the best efficiency in apparel, bar none,” Fung said. “Speed has become a new currency in our field. If you put speed into the equation, China is still the place to be—in spite of a 25 percent tariff.”

While traditional department stores operate on a 52-week cycle of product design, production and delivery, Fung has seen companies in China, India, and Turkey creating and selling products within a span of five days.

Eventually, Fung predicted, full-fledged automation will further diversify the market.

“You will have a factory outside of Boston, outside of New York, [outside] Chicago, just serving the metropolitan areas,” he said. “It will generate a little [number] of jobs and also technology in the U.S.”

Other speakers included:

Lourdes Casanova, senior lecturer and director of the Emerging Markets Institute at Cornell University’s S.C. Johnson School of Management; Michael Enright, director of Enright, Scott & Associates; Janice Lee, managing director of PCCW Media Group, in charge of the company’s media and entertainment businesses; Prahlad Singh (who earned his MBA at Northeastern), president and chief operating officer at PerkinElmer; and Wiebe Tinga, Chief Commercial Officer of Hasbro, a global toy and games company based in Pawtucket, Rhode Island.

A theme among all of presentations was that the global economy is shifting in unpredictable ways.

“One thing that industry is starting to realize is that this trade war could be temporary, [or] it could be permanent,” Fung said. “But whatever happens, even if there is a deal, our recommendation is that you should move out—not completely, but you need to diversify.

“That’s the best strategy. You just never know what else is going to happen.”

For media inquiries, please contact media@northeastern.edu.