European regulators are

cracking down on Alphabet, Apple and Meta. Will that have an impact on how their

products work around the world?

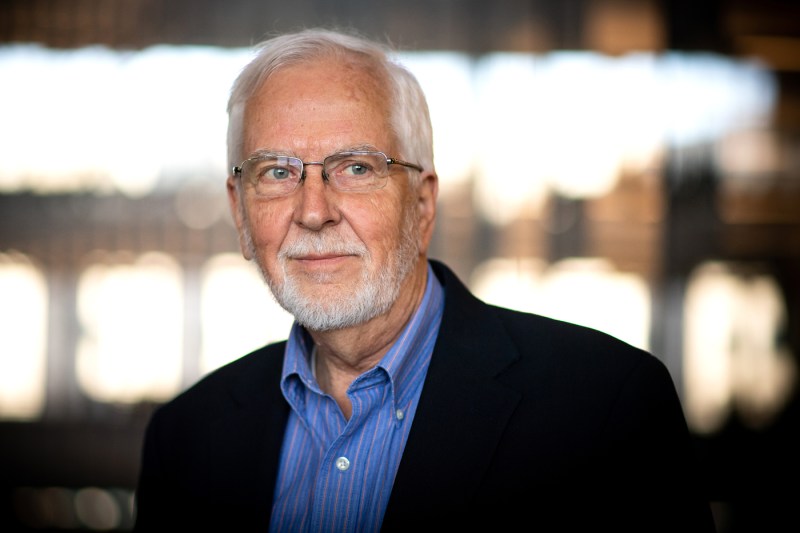

U.S. officials could learn a thing or two from their friends in Europe as they assume a bigger role in taking on Big Tech, says a Northeastern University antitrust expert.

This week, the European Commission announced it was launching non-compliance investigations into Alphabet, Apple and Meta to determine whether they have failed to comply with the Digital Markets Act, which went into effect March 7. The antitrust law mandates that major technology companies deemed as “gatekeepers” must set up their products to be more open and interoperable. The act prohibits companies from giving preference to their own services over others.

The news comes just a week after the U.S. Department of Justice brought a lawsuit against Apple alleging anticompetitive behavior. The DOJ has also brought anticompetitive suits against Google, and the Federal Trade Commission has brought a case against Amazon.

But Europe has the advantage, according to John Kwoka, Northeastern Neal F. Finnegan Distinguished Professor of Economics, because its regulations explicitly lay out its rules. That’s not the case in the U.S since officials are taking these companies to task through the court system.

“The European regulations answer certain questions,” Kwoka says. “In the U.S., we don’t have a law or regulation that says you can’t do self preferencing. That has to be established in every court with regards to every practice of every company. That’s a laborious process of having to deal with it over and over again in the context of a particular case or company proceeding.”

So, what role could the EU’s regulations have on consumers who use these companies’ products outside Europe?

What does this mean for you?

We’ve already seen one scenario in which legislation on Big Tech in the EU has had a ripple effect globally. Last September, in response to legislation to the EU’s common charger directive, Apple abandoned its priority lighting cables in favor of USB-C charging ports on its latest batch of iPhones, Kwoka explains.

Many see that change as a win for consumers across the board, Kwoka says.

“The world didn’t come to an end for Apple when they had to do that,” he says. “It’s hard to conceive of any way in which a consumer is worse off.”

But that was low-hanging fruit for the company, Kwoka says. In other ways, the changes the EU is mandating these companies comply with may hurt their bottom line.

Sticking with Apple for a bit: In January, the company announced that it would begin to allow alternative app marketplaces on iPhones to comply with the Digital Markets Act. That means developers can start developing apps and services for the iPhone that don’t have to comply with the terms of service agreement written in Apple’s App Store.

The catch?

Those app stores will only be accessible in the EU, causing fragmentation in the services Apple provides globally.

Apple likely made that decision because of the profits it has gained by taking about a 15 to 30% cut of all proceeds made in its own App Store, Kwoka says.

Moreover, third party developers have called out Apple for adhering to the EU’s rules through bad faith compliance. They argue the company has made it unnecessarily difficult for developers to create third party app stores, defeating the purpose of the regulation.

That controversy is part of what the EU’s investigations will touch on.

What the EU is investigating

On Apple and Alphabet, EU investigators will look into whether the tech giants’ app stores are in breach of the DMA’s steering rules that mandate that they allow developers to let consumers know of payment methods outside their app stores.

Alphabet will also be investigated to determine if the company is giving self-preferential treatment in Google searches and promoting its Google Shopping, Google Flights, and Google Hotels services.

Featured Posts

On its own, Apple will be investigated on three fronts. First, it will be investigating if the company is allowing users to easily uninstall software applications on iOS. Secondly, it will look into whether customers are adequately given the choice to change default settings on iOS. Lastly, the EU will look into whether the company presents users with an easy-to-use interface on iOS that allows them to change their default browser or search engine.

Meta is also being investigated for its new “pay or consent” model, which calls for users of Facebook and Instagram in the EU to pay to use these services in place of ads.

Companies that are found to be infringing on the act could be subject to pay fines up to 10% of their worldwide turnover and 20% in cases of repeated infringements.

Kwoka isn’t sure if those fines won’t be more than just a slap on the wrist for these large tech companies as they make billions of dollars in annual profits.

Additionally, these companies have so many resources and technology at their disposal to skirt and circumvent these rules.

Enforcing rules on these companies might not be as effective as structural mandates that could reduce the power these companies wield, Kwoka says.

“That doesn’t mean you fully break up the company, but it does mean you create divisions that operate within some of their operations that prevent them from evading the intent of the regulation.”