Here’s how the Supreme Court is likely to rule on Biden’s student loan debt forgiveness plan

President Joe Biden’s debt forgiveness program is headed to the Supreme Court. There’s a lot on the line for borrowers. As many as 59% of borrowers say that, come June 2023, when the freeze on payments is expected to lift, they may not be able to afford to make payments again.

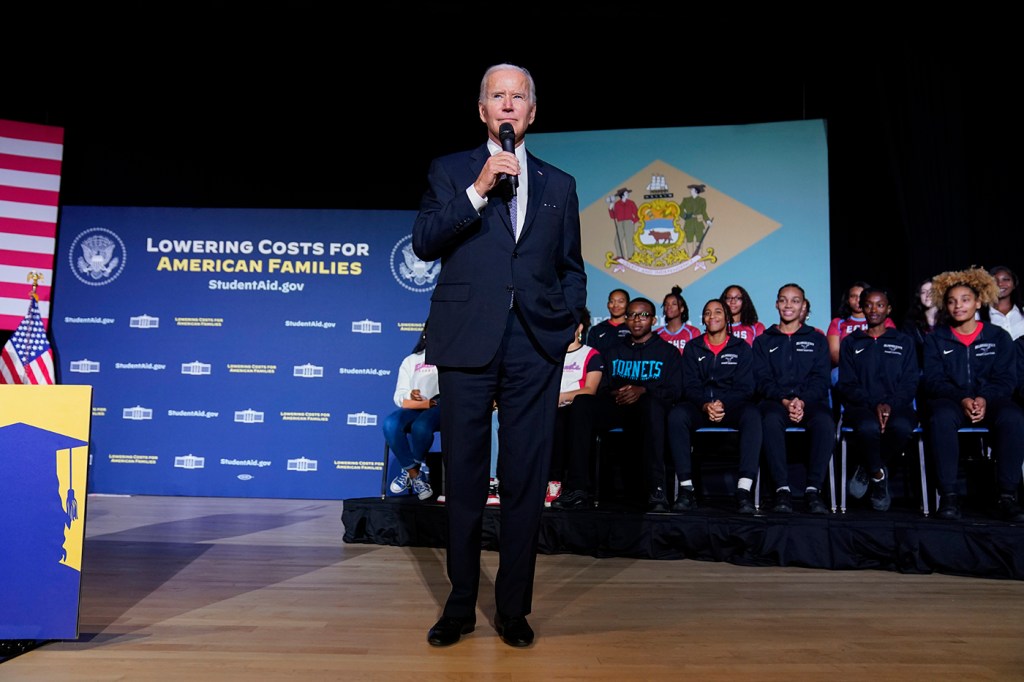

In August, Biden announced that tens of millions of borrowers would be eligible for up to $20,000 in student loan forgiveness. Those who earned less than $125,000 per year, or $250,000 per household, were eligible to receive $10,000 in cancellation, and those who met the income criteria and received a Pell Grant were eligible for up to $20,000 in cancellation.

The plan also included an extended pause on repayments that, as of this week, is active through June 30, 2023, or until the present litigation is resolved. A judge in Texas declared the rule illegal, and a federal appeals court issued a ruling effectively upholding the judgment of the lower court.

News@Northeastern sat down with Dan Urman, director of the Law and Public Policy Minor at Northeastern, who teaches courses on the Supreme Court, to get a sense of how the high court might approach such a high-stakes case. His comments have been edited for brevity and clarity.

How do you see all of this playing out?

The Biden administration has had a pretty rough go at it every time the Supreme Court has been asked to review an executive action. Think about the [COVID-19] vaccine or test mandate: he lost that one. Think about West Virginia v. EPA, which is about a clean power plan. To put it bluntly, this Supreme Court has at least five if not six votes that reins in authority that presidents use that seems like it is congressional authority.

The big picture here is that we live in a polarized political environment; I don’t think I’m telling you anything new. So when Biden can’t get Congress to pass something, he understandably looks for executive action. I just want to be clear that both parties do this. [President] Obama wanted Congress to pass what was called the Dream Act to give a path to citizenship for people who were brought here as children unlawfully. He issued what’s known as DACA and DAPA because of the failure of Congress to act on that issue.

Biden would have loved it if Congress passed some kind of [student] loan forgiveness law. But he decided to use the HEROES Act instead—and of course, good acronyms are always fun. The background on this is that the education secretary can relieve borrowers of their obligation to pay student loans; this is Biden saying, ‘You know what, COVID … counts as an emergency. And I want to provide relief.’ Essentially, he’s decided to reference the HEROES Act to authorize blanket cancellation of loan balances.

I would be very surprised if the Supreme Court allowed Biden to do this. In other words, I really think the Supreme Court is going to say, this is Congress’ job, not the executive’s.

They’re going to say that this exceeds what the statutory language—basically, that this is beyond what the law allows. Pretty basic, right? “Biden is going beyond what the law allows.”

What legal tools, if any, has the court applied to these sorts of issues?

They have a new trick called the Major Questions Doctrine. This is when they say, ‘Oh, we don’t want to think that an agency can address something unprecedented.’ So they’re going to say, like, ‘Oh, we didn’t think the Education Department would be doing a categorical loan cancellation.’ That’s my prediction. They’re going to strike down what Biden did on a categorical basis.

What was the original intent of the HEROES Act?

The original HEROES Act was for deployed soldiers in Iraq. So you see the arguments here for major questions? They’re all versions of basically that what Biden did is “excessive” and essentially beyond statutory authority. Essentially the language here is “war or military operation or national emergency”—I’m going to nerd out here for a second—we call this in statutory “similar in kind.” Think about it, it seems war-like. It just doesn’t sound like a “health” thing. This is what lawyers do.

The core argument by people striking it down is, of course, this is so costly we want to make sure Congress spoke to it directly. The other argument is there is something called “notice and comment rulemaking.” Whenever an agency makes a major rule, it needs to take public comments. Meaning you want to let people weigh in, or due process. There are several ways to attack this.

The whole point is I think this is a fight Biden thinks he can win; meaning the public likes the idea of Biden looking out for people saddled with debt. So he kind of wants a definitive answer, but I also think it’s pretty popular. As you can imagine, one side said it’s a government giveaway and all this, but the other argument is: Biden’s looking out for you, your payments are going to be lower. You could look at it like Biden’s playing politics. Who helped Democrats in the midterms? Younger voters. Who’s saddled with a lot of debt? Younger Americans.

Now that it’s going before the Supreme Court, does that give borrowers more or less time to prepare for a potential resumption of payments?

We’re going to know by June or July. The pause on payments is supposed to expire basically June 30. But they’re [the Supreme Court] going to be able to issue a ruling around that date. It’s going to be close. Get ready for it. Get your bank account ready for the summer.

How do you see Chief Justice John Roberts voting in this case?

On these issues he’s a fairly consistent conservative vote on limiting agencies. I think this is probably a 6-3 decision.

For media inquiries, please contact media@northeastern.edu.