Trump wants to establish an official cryptocurrency reserve. How would that work?

The move could increase the value of digital currencies, a Northeastern expert says, but the volatility of digital currencies comes with a lot of questions, ethical and financial, for any government.

President Donald Trump plans to establish a Crypto Strategic Reserve that would involve the federal government getting deeply involved in the buying, holding and selling of digital currencies.

Trump announced that the reserve would include not only bitcoin, the longest-running and most valuable cryptocurrency, but ether, the second-most valuable popular cryptocurrency, as well as three lesser-known ones: XRP, solana and cardano. Trump is likely to provide more details during the White House’s first cryptocurrency summit on March 7.

It’s a move in line with Trump’s campaign promise to make the U.S. a leader in crypto, as well as his own personal interest in digital currencies. It’s also a potential game-changer for, if not the U.S., then at least the crypto market.

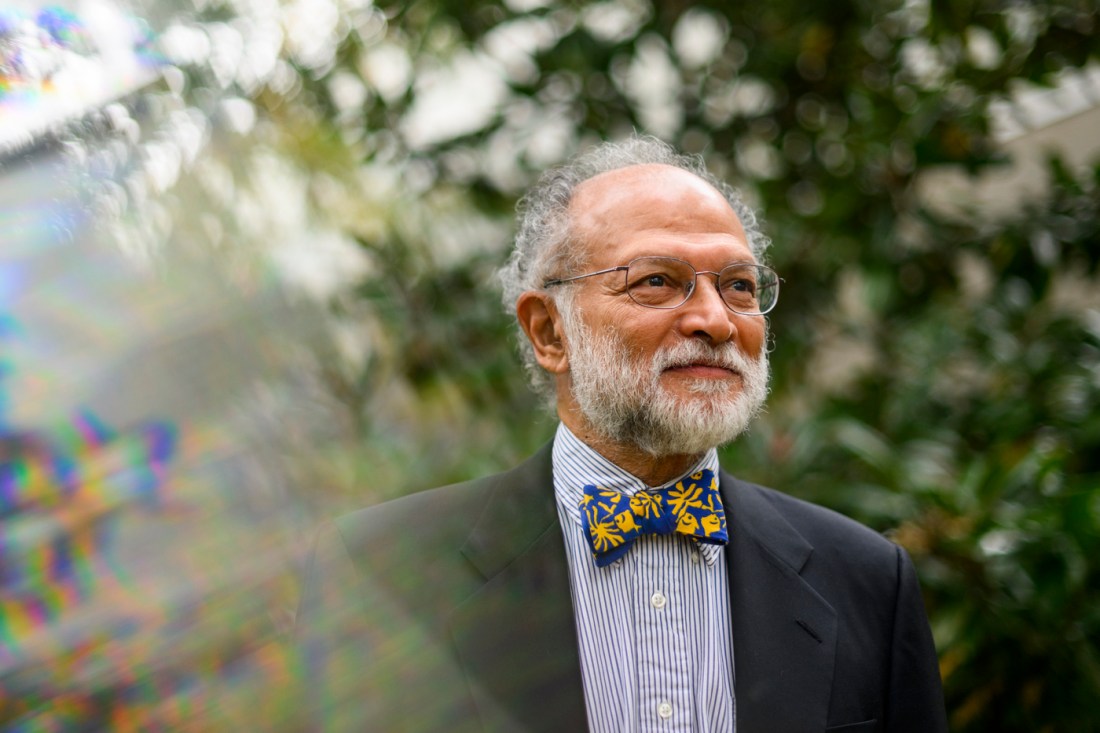

“In a sense, bitcoin investing has become easier and much more mainstream,” Ravi Sarathy, a professor of international business and strategy at Northeastern University. “This government initiative that says it’s going to officially include bitcoin and four other cryptocurrencies as part of a strategic reserve makes it even more legitimate.”

But how exactly would a crypto reserve work?

Over the years, the U.S. has established a number of strategic reserves of, usually, limited supply resources, like gold, petroleum and medical supplies, to mitigate the impact of supply disruptions and to stabilize prices. This would be one of the first times the U.S. did something similar for a purely digital asset, although the government already holds about 200,000 bitcoin, worth around $16.8 billion at current market value, confiscated from illegal activities and transactions.

With these kinds of reserves, the intent is typically not to buy and sell assets but to “put them away permanently as part of a portfolio of gold and other assets,” Sarathy says.

Sarathy says one possible reality for how the strategic reserve operates has already been spelled out.

The Bitcoin Act of 2024 was a bill introduced by Sen. Cynthia Lummis, R-Wyo., that proposed establishing a strategic reserve of bitcoin. Specifically, the bill directed the Treasury Department to purchase 1 million bitcoins over the course of five years that it would then be required to hold in reserve for at least 20 years. The exception would be for the U.S. to use its bitcoin reserve to pay off portions of the national debt. The bill has still not been co-sponsored.

In the case of bitcoin, the government’s sudden involvement could mean prices go up, as they did temporarily in the aftermath of Trump’s announcement, Sarathy says.

Editor’s Picks

There is a maximum of 21 million bitcoin that can be issued, and the market is approaching 20 million already. Sarathy says about two-thirds of that total is not traded but sits in long-term holdings that belong to individuals and private entities. That leaves about 6 million to 7 million bitcoin that can actually be traded.

“Given that supply is restricted, the U.S. government coming in to buy could drive the price up significantly,” Sarathy says.

One bitcoin is currently worth around $83,000, although the value fluctuates rapidly. Sarathy says that the lower supply would not eliminate the crypto market’s notorious volatility but could mitigate it somewhat.

“It gives you a one-way option: You don’t have to worry too much about the price dropping, but you can certainly speculate that the price will rise,” Sarathy says.

Sarathy anticipates that the establishment of a federal crypto reserve could have a far-reaching halo effect. It could signal to financial entities, state governments and leaders in other countries that crypto is more legitimate, further increasing demand.

However, there are still serious concerns about what it means for the U.S. to rely on such a risky asset, particularly for reducing the national debt.

“Bitcoin is volatile and starts losing value when there’s some kind of crisis,” Sarathy says. “If you look at the past few months, bitcoin has been volatile and moved in line with news coming out about tariffs, inflation and war. … The danger, of course, is that if there is a major crisis, then bitcoin might crash, like it has three times in the past.”