Why do the betting odds decisively favor Trump in what appears to be a ‘coin flip’ election?

“One of the great misnomers is that betting lines are a predictor of outcomes, but that’s not what they are,” says Harry Levant, director of gambling policy at Northeastern’s Public Health Advocacy Institute.

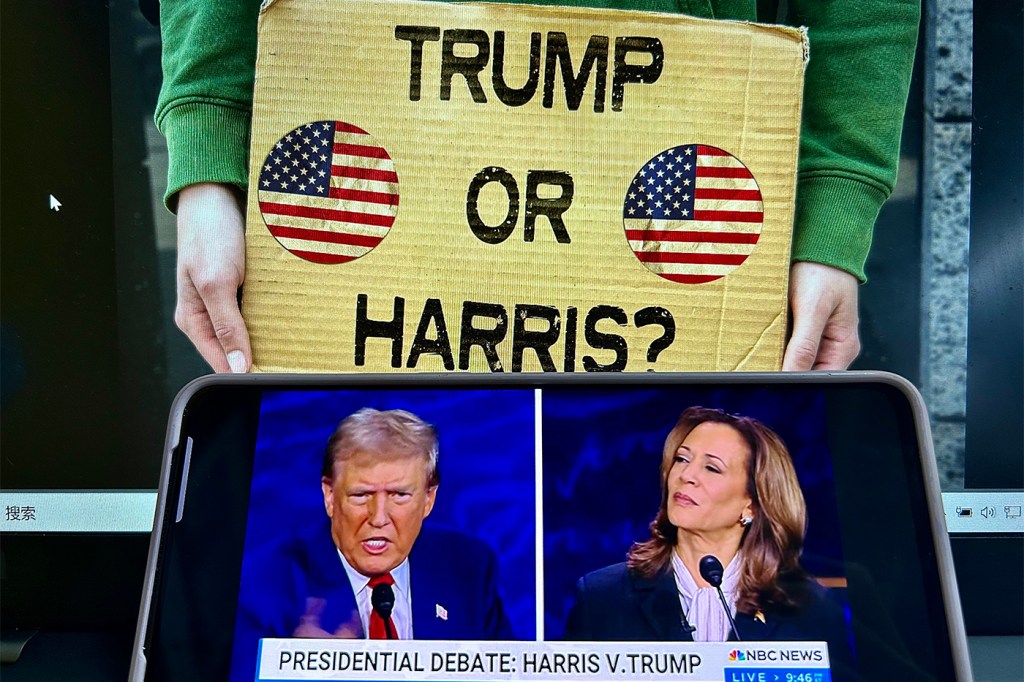

The polls refer consistently to the 2024 presidential election as a dead heat. Real Clear Politics’ aggregation of national polls gives Kamala Harris a scant 0.2% lead over Donald Trump. Fivethirtyeight has Trump winning 51 times per 100 simulations. The Economist simulations favor Trump 53% of the time.

All of these analyses are operating within a statistical margin of error.

“This election is a coin flip,” says Matan Harel, a Northeastern University assistant professor of mathematics.

So why then is Trump listed as a relatively strong 61.7% favorite on the crypto platform Polymarket? The U.K.’s Betfair Exchange predicts a “likely win” for Trump.

The answer, says a Northeastern gambling expert, has to do with the economics of sports betting.

“One of the great misnomers of the gambling industry is that betting lines are a predictor of outcomes, but that’s not what they are,” says Harry Levant, director of gambling policy at Northeastern’s Public Health Advocacy Institute. “They’re meant to be a predictor of human behavior.”

It’s all about the money, Levant says. The betting companies manage the odds for the purpose of keeping 10% or more of the money wagered (known as the vigorish) for themselves. The companies establish and maintain a betting line that enables them to protect their vigorish.

“Gambling operators are trying to attract an amount of money on both sides of a wager,” says Levant, noting that the ultimate goal is for the wins and losses to offset each other — leaving the betting companies to walk away with their profit intact.

It’s all about public perception

A common misunderstanding, says Levant, is that gambling companies have money in the prediction game and, therefore, are more likely to be correct in their assessment. The truth, he says, is that the companies are focused on how the betting public feels about the race.

“All of these odds and point spreads are really predictors not so much of human behavior as they are predictors of gambling behavior,” Levant says. “If they can attract money on Donald Trump as a 60% favorite, and it’s requiring them to make the odds on Vice President Harris more favorable to bettors to encourage them to put money on her, then the companies will move those odds to adjust for human perception. It’s not a prediction of the outcome, it’s a prediction of what they need to do to make the equation work so that they make their profit.”

The bottom line?

“I place no credibility or importance in how the betting public is reacting to a gambling opportunity being marketed by gambling companies both in the United States and offshore,” Levant says. “This is not a political issue. It’s a gambling issue.”

The action has been taking place offshore because U.S. law traditionally has prohibited betting on elections — a stance that was undermined by an Oct. 2 federal appeals court ruling that opened the way for the prediction exchange platform Kalshi to allow wagers on congressional elections.

“We live in an era where we are grooming people to bet on anything. We are normalizing an addictive product,” Levant says. “Regardless of your politics, this is a presidential election of historic proportions and it’s going to have implications not only in this country but around the world. The idea that gambling companies are looking to capitalize on the public interest is a further normalization of the addictive nature of gambling.

“In this case the betting public is interested in Donald Trump, so the companies are making it more expensive to gamble on Donald Trump, and they’re giving you a little bit more incentive on Vice President Harris. But this is absolutely and positively not an indicator of any political outcome. All this shows is that gambling companies will take action on anything anywhere they are permitted.”

Editor’s Picks

Too close to enable a prediction

From Harel’s standpoint as a mathematician, the polling is too close to enable a confident prediction — even if the polls ahead of the 2020 presidential election were found to be the most inaccurate in 40 years.

“I am a believer that the professionals are doing their damned best,” Harel says of the credible pollsters and analysts of the election. “I choose to take the information they provide at face value and, given that information, I have not met — I have not heard from a single person — who thinks that they know what’s going to happen in two weeks.”

The betting market confidence in Trump appears to be based on his slight advantage in the seven swing states that may decide the election. Trump holds a 48.4-47.5 advantage over Harris in the top battlegrounds, according to Real Clear Politics.

But Harel notes that the accuracy of polls is dependent upon a representative random sampling of the population — something that has become increasingly difficult in the nation’s polarized environment.

“As mathematicians we tend to ask relatively simple questions, because even the simple questions are hard,” says Harel, whose work focuses on probability. “In this case there are so many factors. Humans are really complicated. Elections are incredibly complicated.

“This is why I am deeply skeptical,” Harel says of Trump’s betting advantage. “I am deeply, deeply skeptical that there is a 60-40 split. This is a coin toss.”

Is Wall Street betting on a candidate?

U.S. financial markets are also being seen as betting on the election outcome.

“The market and the inside of the market is very convinced Trump is going to win,” billionaire investor and former hedge fund manager Stanley Druckenmiller told Bloomberg in an interview. “You can see it in the bank stocks, you can see it in crypto, you can even see it in Trump Media & Technology Group Corp., his social media company.”

But Robert Triest, a Northeastern economics professor who served as vice president and economist at the Federal Reserve Bank of Boston, says that firms may be taking actions to position in case Trump wins.

“It’s very difficult to interpret asset price movements as indicating that investors think that one candidate is going to win versus the other,” Triest says. “The relationship between who wins the election and which kind of companies will benefit is fairly tenuous.

“There are certain things in Trump’s policy views that suggest some sectors would benefit relative to others, but it depends a lot on what he can do with executive action versus what would have to go through Congress. And then, if it needs to go through Congress, it’s going to depend a lot on which party controls the House and Senate.”

Adds Triest: “I don’t think we can read a lot into what’s going on in financial markets as indicating anything about the election.”