Why the Federal Reserve will wait until September to cut interest rates, expert explains

Wall Street’s eyes will be on the Federal Reserve this week, as the board meets Wednesday to decide whether to cut interest rates.

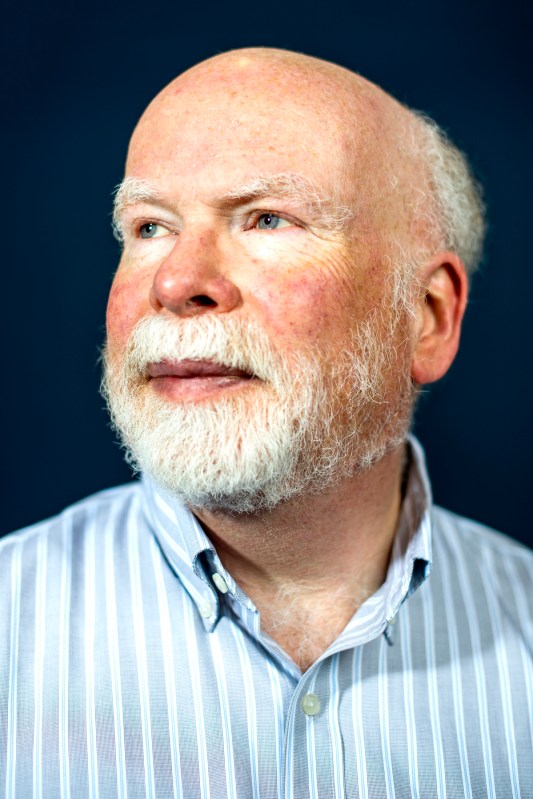

Northeastern University economist Bob Triest says there are two reasons why the Fed will likely wait to cut rates until its next meeting in September.

“The inflation data has surprised the Fed and economists a couple of times this year — earlier in the year it came in higher than had been expected and recently has come in a little lower — so the Fed may feel a little cautious about prematurely declaring that inflation is well on its way to hitting the Fed’s target of 2%,” says Triest, professor of economics at Northeastern.

“The second reason would be that the Fed doesn’t like to surprise people with the policy moves they make, and they haven’t really prepared the public or financial markets for their cutting rates at this meeting.”

That being said, Triest says there is one reason why a rate cut could happen this week.

“One reason for moving in now rather than waiting until September is that it’s very important for the Federal Reserve to be apolitical and to appear apolitical,” Triest continues. “They tend to avoid making big policy changes when it’s very close to an election and we’re further away from the November election now than we will be in September.”

The Fed interest rate is currently 5.25% to 5.50%. Two years ago, in July 2022, the rate was 2.25% to 2.50%. Prior to the COVID-19 pandemic, the rate was 1.50% to 1.75% in January 2020.

Recent inflation peaked at 9.1% in June 2022, and the Federal Reserve has raised interest rates aggressively in an attempt to bring inflation down to 2%.

Two years later, consumer prices declined 0.1% in June compared with May, and annual inflation came in at 3%. This annual inflation rate was down from 3.3% in May, and was lower than economists expected.

But Triest explains that the Federal Reserve is trying to pull off a balancing act — cool the economy and tamp down inflation by raising interest rates, but not throw the economy into a recession.

Thus, the Fed is also looking closely at economic growth, which was up this quarter at 2.8% (more than economists expected) and the labor market, which has avoided (so far) a sharp pullback.

Triest says these data are “consistent with being the right time to cut” for the Fed.

He adds, however, that the Fed usually telegraphs its intentions through speeches or statements.

“There hasn’t been that,” Triest says. “So they may prefer to begin that kind of preparation now and then actually wait until the September meeting to cut rates.”

So, Triest is looking for two things in the statement that the Fed releases Wednesday afternoon after its meeting and in Federal Reserve Chairman Jerome Powell’s subsequent press conference.

First is how the Fed will classify inflation.

“There’s a paragraph (in the statement) on the balance of risks, and they probably will downgrade the inflation risk part of that statement,” Triest says.

Second will be hints at a rate cut in September, the kind of prepping of the market that usually precedes a policy change.

“The Fed is very unlikely to explicitly say that they’re cutting in September,” Triest says. “But I think it’s likely that if they don’t cut directly tomorrow, that they will hint at that in the statement and that Powell will further elaborate on that.”

Finally, Triest is looking even beyond September.

“The question is will the Fed be cutting interest rates regularly, at every meeting, every other meeting, or Powell may just want to talk about only September,” Triest says.