JetBlue’s $3.8B merger with Spirit goes to court. Who will win?

The federal government has taken JetBlue to court in an effort to stop a $3.8 billion merger with Spirit Airlines, but don’t rule out a settlement in the case, says a Northeastern University airline industry expert.

The trial kicked off Oct. 31 in U.S. District Court in Boston before Judge William Young, and is expected to last about four weeks.

JetBlue contends that the merger would create a “stronger customer-centric, low-fare national challenger” to the dominant Big Four airlines, behind American Airlines, Delta, United and Southwest. The Justice Department argues that cost-conscious consumers are better served with the “ultra-low-cost carrier” Spirit. JetBlue currently ranks sixth, and would jump Alaska Airlines if it merges with Spirit.

According to the proposed merger, JetBlue will pay $33.50 per share, which is an equity value of $3.8 billion. The merger would give JetBlue about 9% of the market, according to a JetBlue press release. Meanwhile, the Big Four control about 80% of the market.

The merger was announced last year.

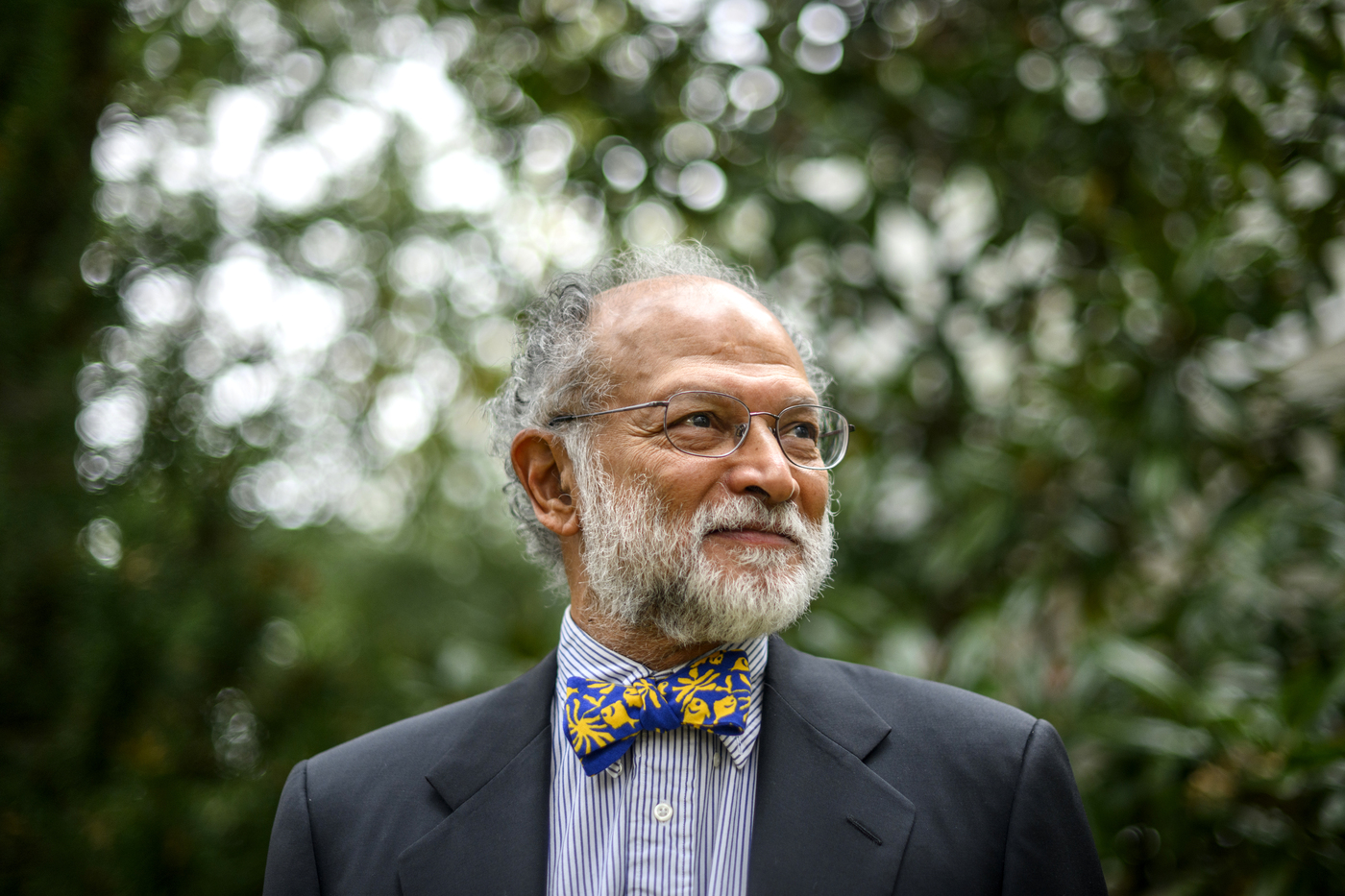

Northeastern Global News spoke to Ravi Sarathy, a D’Amore-McKim School of Business professor of international business and strategy who studies the airline industry, about the JetBlue antitrust case. His comments were edited for brevity and clarity.

The Justice Department is suing JetBlue to stop the merger with Spirit Airlines. Why is the DOJ challenging the merger?

There are only four airlines, basically, American, Delta, United and Southwest. And then you’ve got Alaska and JetBlue, and then the small, ultra-low-cost carriers. So the top four control more than 80% of all traffic in the U.S. So it’s a very concentrated industry. And so the Justice Department naturally is worried about increasing concentration.

JetBlue was already one of the smaller airlines, and they were kind of — in strategy terms — stuck in the middle. They were not quite up there with the Americans or the Deltas or the Uniteds, but they were also not a completely low-cost airline like Spirit.

The Justice Department is worried about concentration in the industry, and having Spirit and JetBlue merger would increase the concentration because there’d be one less competitor.

The Justice Department doesn’t want to see consumers hurt. They think prices will go up if JetBlue takes over Spirit. And I think JetBlue has said, ‘We’d like to make them more like us.’ In other words, offer a slightly higher level of amenities, but that also means raising fares.

The merger would create the fifth-largest airline, not even a top three or four airline. Is that a strong antitrust scenario?

It’s a relative matter. If you had six and now you have five, and the airline that’s disappearing is the lowest-cost airline — ultra-low-cost airline — and emerging with an airline whose prices and fares are higher, whose cost structure is higher, then on the whole, consumers can’t find as cheap fares as they used to. I think that’s the number one reason.

And also it’s good to have, even for the big guys — like Delta and American and United — having a Spirit meant that they had to make sure that they offered basic economy fares, and with Spirit gone, that pressure goes down also on them.

Who will win this antitrust case?

It’s so hard to predict, but if JetBlue is willing to give up a lot in order to make the merger happen, then the DOJ might be satisfied.

If I had to take a bet, I would say neither side will win, because what’ll happen is there’ll be a settlement that JetBlue will be allowed to keep a much reduced version of the merger. That would be my guess on the outcome.

I think JetBlue will give up a lot in terms of gates in order to try to make the merger succeed. They’ve already invested a great deal of time and money in this, and they probably don’t want to be shut out. They might say ‘half is better than none. So even if the merger won’t give us all of our initially planned benefits in the longer run, if we are allowed to merge, it’ll probably help us.’

There is an argument that JetBlue may learn from Spirit and essentially operate two brands, like some companies have a high-end brand and a more mid-price or consumer friendly brand. And then have essentially two clients.

I think it’s in their best interest to try to negotiate with the Justice Department.

What criteria will the judge use to make a decision?

There’ll be some very specific things like how many routes did Spirit operate that they competed with JetBlue, and what were the fare differentials? And after the merger, how many routes will be reduced capacity? So let’s say JetBlue and Spirit were flying from Boston to Orlando, you know, twice a day each. And so you had a total of 500 or 600 seats. And so what they look at is, will the number of seats go down on those kinds of routes. That would be one criteria.

Second, they’ll probably look at the competing models that JetBlue will offer and the Department of Justice will offer, and maybe some consultants that they’ve hired will offer saying, on the different scenarios, what will the probable fares be?

They’ll look at how many flights might be canceled.

They might look at remedies. JetBlue said they’ll be happy to give up some gates at certain airports where they think the competition may be reduced because of the merger. They’ll give up some gates so that some other airline can fly there and provide the competition that Spirit used to offer.

They’ll probably listen to the unions. I think the unions will have some role because they’ll be worried about what’ll happen to jobs if there’s fewer jobs available?

They might listen to the cities because some of the smaller cities might complain that, ‘We used to have two flights a day. Now there’s only going to be one flight a day, or there’s going to be no flights at all.’

They’re going to take a number of these perspectives, but the bottom line is going to be some judgment about what this will do to airfares and what will this do to passenger capacity, and what will this do to route expansion, because Spirit was aggressively expanding, creating more flights on more routes.

What would the merger mean for the airline industry?

In the short run? I think if the merger goes through, there will be some increase in fares, on average, on these low-cost routes. In terms of capacity, it won’t be growing as fast as it was originally planned, because we are in a recession, and so airline demand, particularly discretionary demand, is going to go down. And airlines have already started cutting prices compared to say the previous six or seven months.

That’s the environment we’re going to be facing for the next year, where it’s hard to have the ability to raise prices significantly unless you’re the monopolist. The price rise will be constrained by macroeconomic considerations.

Mark Conti is managing editor of Northeastern Global News. Follow him on X/Twitter @markconti11.