What is an economic ‘soft landing’ and why are economists ‘cautiously optimistic’ the US will achieve one?

An economic “soft landing,” although often “elusive,” is “a primary objective” of the Federal Reserve. But what exactly is it and how will we know if we achieve it?

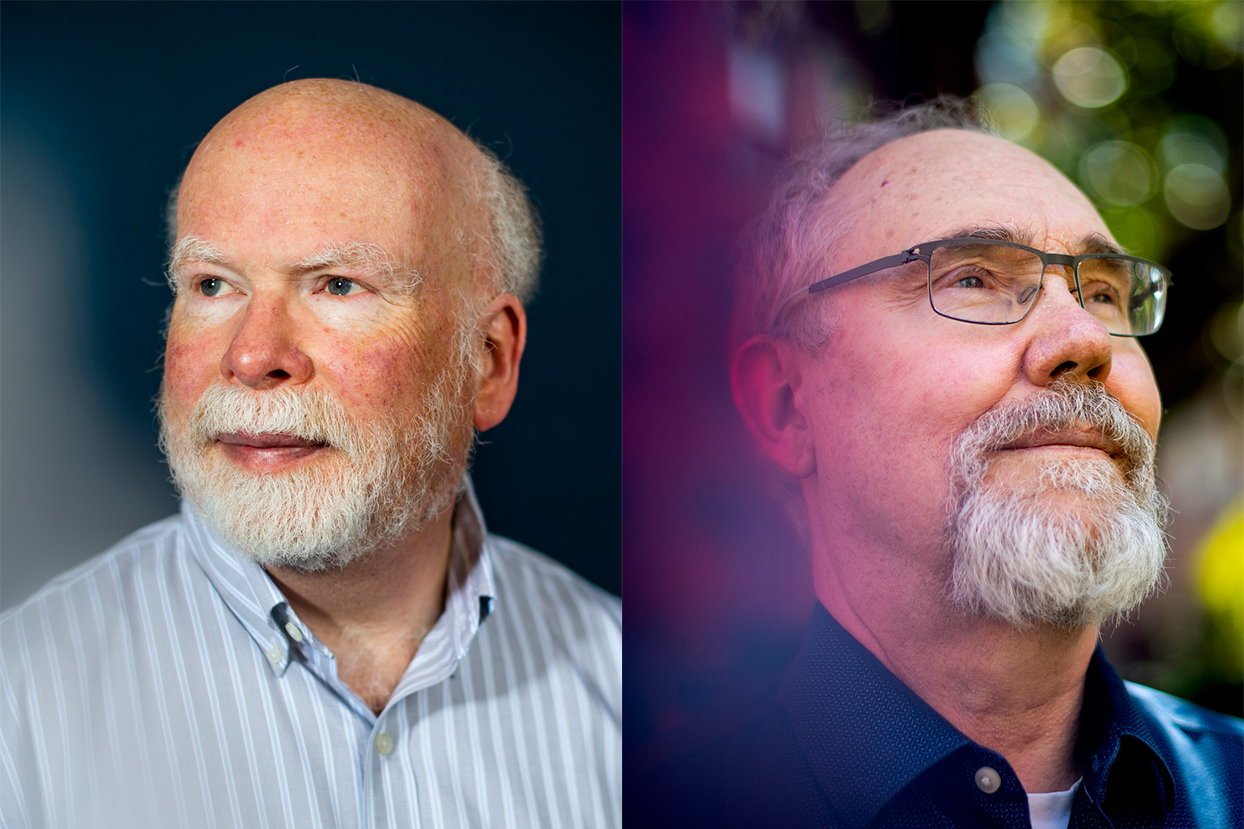

Robert K. Triest, professor and chair of the Department of Economics at Northeastern University, and William Dickens, a professor of economics and public policy at Northeastern, described a soft landing as using monetary policy to reduce inflation without tipping the economy into a recession.

As for where we are in regards to such an outcome?

“We may not have stuck the landing yet, we may be on the runway,” Dickens says. “But we’re still carrying a lot of speed, and still in danger of going off the runway.”

Triest, meanwhile, describes himself as “cautiously optimistic that we’re going to have a soft landing this time. Generally, they are extremely difficult to pull off.”

Inflation concerns first arose in March 2021 and — although Federal Reserve Chairman Jerome Powell predicted at the time and again later that summer that inflation would be “transitory” — annual inflation passed the 2% target rate in June 2021 and continued upward. The Fed began raising short-term interest rates in March 2022 to tame inflation and cool the economy, but inflation peaked at 9.1%, a 40-year high, in June 2022.

Most economists predicted a recession would follow the Fed’s belt-tightening.

“That is normally the postwar history of the U.S. and other economies as well,” Dickens says.

But those predictions are changing with a succession of economic news showing consumers continuing to spend, unemployment remaining at historic lows and inflation falling to 3.7% as of September.

Last week’s surprising announcement of 4.9% growth in gross domestic product this latest quarter continued that trend of data showing a strong economy. The Fed left interest rates unchanged on Nov. 1, but left the door open to raising them later to keep slowing inflation.

“I would say that it may be too good,” Dickens says, explaining that it could cause the Fed to raise interest rates again down the road. “It may be a sign we’re growing too fast.”

Hence the worry about careening off a runway.

But Dickens says “two out of three of the signals” of a soft landing are “already there.”

The unemployment rate seems to be stable, he says. Meanwhile, inflation — while still above the Fed’s target range of 2% — is stabilizing at around 3.5%.

“It’s higher than the target range but only slightly,” Dickens says. “It’s in the range where the Fed will not be as worried about the current rate of inflation but more on what pressures might be on future inflation.”

Thirdly, the Fed is looking for sustainable growth — a measure that includes GDP, labor force participation (an increase of 0.5% as of September and nearly back to pre-pandemic levels) and labor productivity (an increase of 3.5% as of September).

“You don’t want GDP outgrowing the economy’s ability to produce that GDP,” Dickens says.

And those numbers are a little off.

“My guess is very roughly speaking, we would be happy with 2.5% GDP on average, and 2% to maybe 2.5% productivity, and 0.5% labor force participation,” Dickens says.

So, what are Dickens and Triest looking as further signs that a soft landing may be achieved?

“Everyone’s going to want to look at more than one quarter of GDP and even more so, with labor productivity numbers,” Dickens says. “We’re continuing to watch the unemployment rate, continuing to watch what happens with GDP growth and what happens with inflation.”

And to be sure, we haven’t landed Dickens’ plane quite yet.

Triest noted that the Fed’s tightening affects the economy with a lag.

“The threat to a soft landing is that the increase in interest rates, including the recent rise in long-term rates, might still slow economic activity to the point where we have a mild recession,” Triest says.

The Fed kept interest rates steady at its Nov. 1 meeting; however, inflation remains a concern.

“The question is whether it will continue to come down,” Triest says of inflation. “But it appears that the macroeconomy is sufficiently resilient and that the Fed has been able to bring the inflation rate down significantly. If that continues, then we very likely will have a soft landing.”

Cyrus Moulton is a Northeastern Global News reporter. Email him at c.moulton@northeastern.edu. Follow him on X/Twitter @MoultonCyrus.