What are the political implications of the US credit downgrade?

For only the second time in history, a ratings agency downgraded America’s long-term credit rating on Tuesday.

Northeastern University experts greeted the news with a shrug.

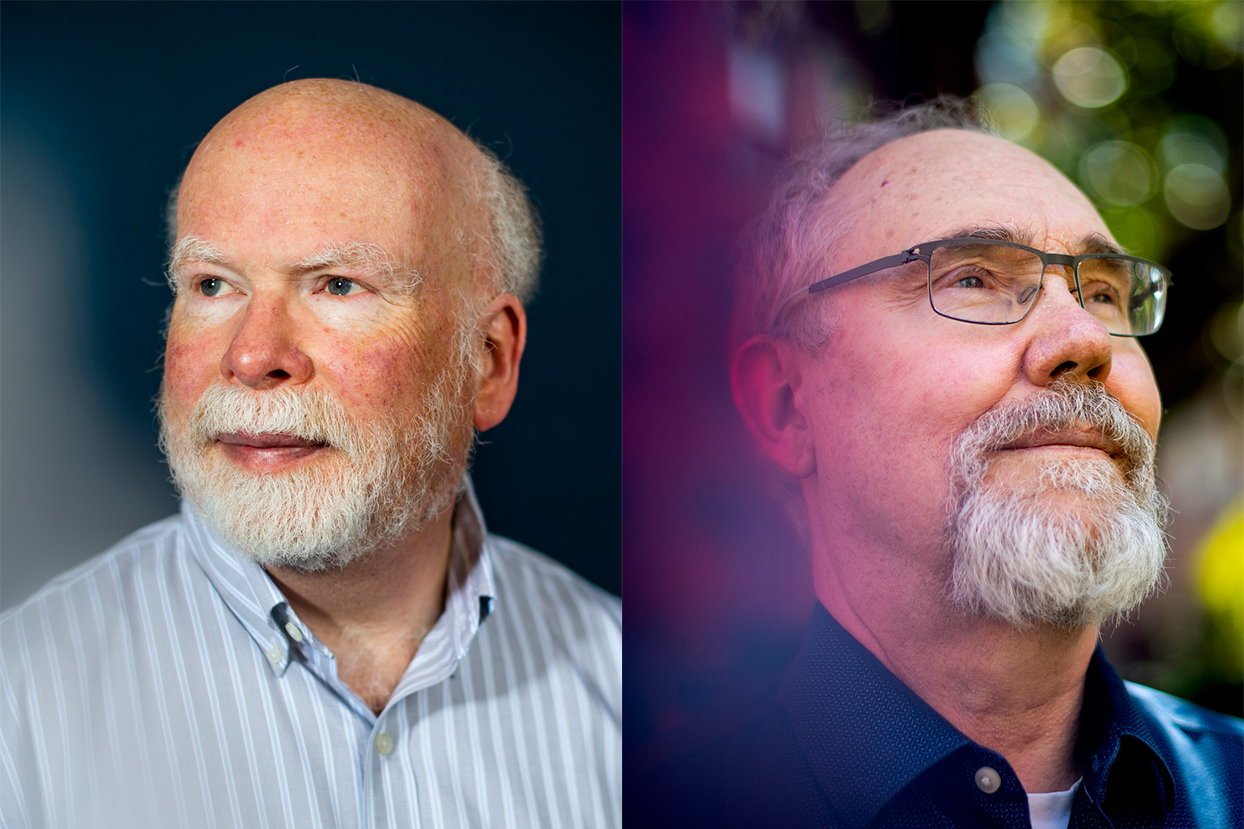

“It’s news that they did a downgrade, but it’s really not changing anything,” says Robert K. Triest, professor and chair of the Department of Economics at Northeastern. “It’s doubtful there would be any discernible impact on any real economic activity.”

Economics and Public Policy professor William Dickens concurred.

“Politicians will make hay of it,” Dickens says. “But in terms of an economic event, my guess is you won’t see it on the bond markets, because the information is already out there that they are basing it on.”

On Tuesday, Fitch—one of the three major credit ratings firms, along with S&P Global Ratings and Moody’s—downgraded the U.S. long-term credit rating from its highest rating of AAA to AA+. It was the second such downgrade in U.S. history. In 2011, amid a debt-ceiling dispute, S&P also downgraded the U.S. from AAA to AA+, where it remains today.

Fitch cited a high and growing debt burden as well as a predilection for brinkmanship concerning the debt-ceiling as eroding confidence in the country’s fiscal management.

“The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management,” Fitch said in a statement. “In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process.”

Fitch also cited growing levels of national debt due to tax cuts and spending. The firm said the U.S. had made “limited progress” resolving challenges related to the rising cost of programs such as Social Security and Medicare.

The news sent stocks and bonds tumbling, at least according to news outlets (Triest says a “causal relationship” between the events is difficult to ascertain).

But what does the rating decision really mean?

Basically, the downgrade means that securities issued by the U.S. Treasury are not as safe as the very safest bonds available in the sovereign bond market.

There are a few factors that insulate the U.S. from major economic disturbance from the ratings change, however.

First, the United States is a major economy with a major global presence.

“It’s not like when they downgrade the debt of a developing country, when people don’t know what’s going on there and don’t follow the politics,” Dickens says. “Downgrades can have an effect on smaller countries, but downgrades on the U.S. where everyone knows our business? It’s not going to matter.”

Secondly, Triest notes the U.S. dollar’s status as the world’s reserve currency.

“U.S. treasuries will still have a special place in terms of where investors will put their money,” Triest says.

But perhaps most importantly, the downgrade doesn’t really say anything new, the experts say.

“None of the list (of Fitch’s concerns) is based on anything that has changed recently,” Triest says. “It’s reflecting concern, but nothing that’s really new.”

“It’s kind of an indicator of the underlying symptom we have of deterioration of the political process that makes it more difficult for our government to solve fiscal problems,” Triest continues. “But that’s been decades in the making.”

Dickens agreed.

“If the bond market was going to react, it already would have, and would have reacted a long time ago,” Dickens says.

Nevertheless, the downgrade is rife for political sniping … with predictable battle lines.

“I’d say Republicans will point to this as indicating that we need to constrain spending,” Triest says. “Democrats will point to this as having other sources, especially in the political gridlock in the Republican Congress.”

The pundits and politicians did not disappoint.

In fact, the downgrade can be seen more as a political problem than an economic one.

“The key thing though is the political dysfunction—we’re facing the problem currently of passing the budget bills, we came to wire in the debt limit—and that type of political dysfunction is not conducive to good fiscal policy,” Triest says. “That’s the problem. The Fitch downgrade is the symptom of the problem and, in itself, the Fitch downgrade doesn’t really matter too much.”

Cyrus Moulton is a Northeastern Global News reporter. Email him at c.moulton@northeastern.edu. Follow him on Twitter@MoultonCyrus.