Why are John Legend and Bruce Springsteen selling the publishing rights to their hits?

John Legend. Bruce Springsteen. Imagine Dragons. Bob Dylan.

It sounds like the lineup for an upcoming mega world tour. In fact, it’s a who’s-who of big-time musical acts who recently sold the rights to their publishing empires.

The transactions have drawn quite a bit of attention—if not for the eye-popping sums, then for the nostalgia of some of the world’s most recognized songs. They include “What’s Love Got to Do With It?” by Tina Turner, “Go Your Own Way” by Fleetwood Mac, and “Legs” by ZZ Top. All of those artists have sold their music catalogs.

Legend’s sale alone encompassed some of his popular tunes—“Ordinary People,” “Green Light,” “All of Me,” and his 2014 Grammy- and Oscar-winning track with Common, “Glory.”

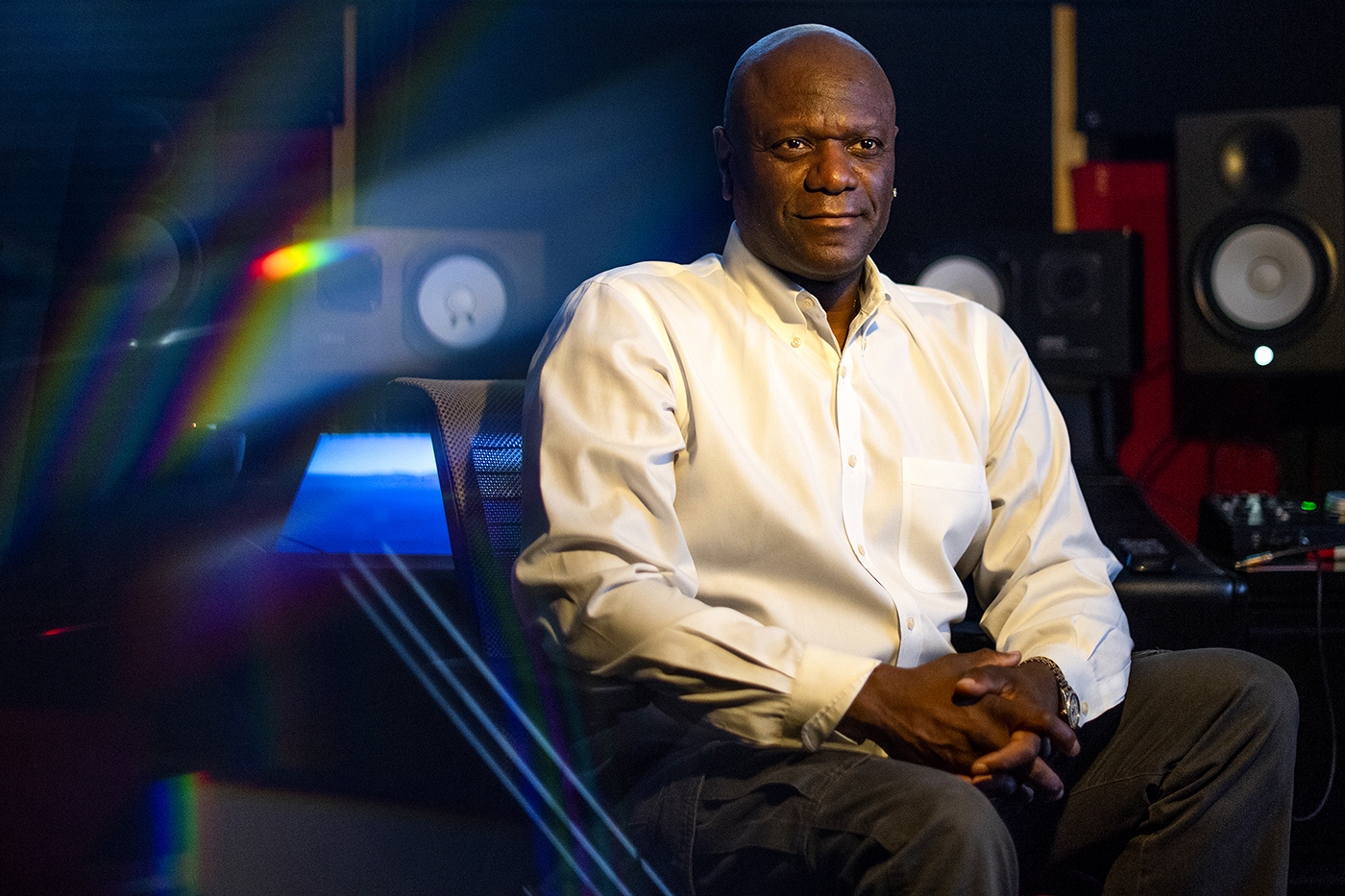

There are at least 42 income streams in the music industry, split among the songwriter and composer side, and the performer and recording artist side, says music professor Charles Alexander. Photo by Matthew Modoono/Northeastern University

While selling catalogs is not a new phenomenon—as far back as 1985, Michael Jackson outbid Paul McCartney for the rights to the majority of the Beatles’ songs—today’s sales are indicative of a number of new factors, including technology-driven changes in the industry, and present-day economics, according to Northeastern professors.

“As interest rates go down, the value of an asset goes up,” says Russ O’Haver, who teaches economics in the D’Amore-McKim School of Business. “The asset here is the future royalty stream attached to the music catalog.”

Typically when an artist’s song is played in restaurants or used in a movie or a TV ad—Fatboy Slim’s hit “Praise You” was featured in a Mercedes ad—royalties are primarily tracked by two organizations: BMI and the American Society of Composers, Authors and Publishers.

Royalties are then paid to the artist, who owns copyrights on the recording and possibly the underlying music. There are tax implications connected to those payments. Politicians in Washington were debating last summer whether to hike personal income taxes on the wealthy to raise revenue.

The idea was later shelved, but had it become law it could have led to a bigger tax bite for artists. “That could have been a motivation for them to start unloading their portfolios to the highest bidder,” O’Haver says.

That may especially be the case for older legacy artists, such as Springsteen, more than for younger ones, such as Legend. Springsteen sold his music rights for more than $500 million to Sony Music Entertainment in what could be the biggest sale ever for a solo artist’s songs. The deal includes “Born to Run,” “Born In The USA,” “Dancing in the Dark,” and “Glory Days.”

“I’m thrilled that my legacy will continue to be cared for by the Company and people I know and trust,” Springsteen said in a statement issued by Sony, which owns his record label, Columbia.

O’Haver says Springsteen, 72, is “getting up there in age” and may be inclined to cash out now rather than leave it as part of his estate. “These are rock stars after all,” O’Haver says. “Delayed gratification is usually not a big part of their personality.”

Older singers such as Bruce Springsteen, who made over $500 million from the sale of his catalog of hit songs, may be motivated to cash out now while they’re still alive, says Russ O’Haver, who teaches economics in the D’Amore-McKim School of Business. Photo by Alyssa Stone/Northeastern University

Before becoming a professor, O’Haver worked for a big consulting company. One of his clients was another aging superstar—McCartney. O’Haver was responsible for determining the value, and the tax implications of using the ex-Beatle’s name and likeness in different countries.

For example, some of the copyrights to McCartney’s songs are owned by his company in London. And he may have a U.S. subsidiary in New York that tries to place his music in a Hollywood film or TV commercial. “Those are two different taxing jurisdictions with two different tax rates,” says O’Haver.

The fee for placing a McCartney song in an advertisement in the United States is split between the London and New York entities, and is known as the transfer price.

How does a singer make money?

There are at least forty-two income streams in the music industry, split among the songwriter and composer side, and the performer and recording artist side. Streams could come from touring and merchandise sales, among other things.

From there, income for recording artists can be achieved actively, meaning they get paid immediately, and passively, which is compensation in the future.

“Copyright is probably the most prolific of those future incomes,” says music professor Charles Alexander, known as “Prince Charles” when he had a funk band in the 1980s. He would later become a producer and audio engineer for Mary J. Blige, Puff Daddy, Boyz II Men, and Sting, among others.

Copyrights typically involve publishing—the servicing of a composition—and writing.

“When you create a song, you already own 100 percent of the writing side and 100 percent of the publishing side” if you don’t have a record label deal, Alexander says.

For those fortunate to have a label’s backing, and all the funds that come with it, writers have the option to sell part of their business. “And the one part of the business that most people sell is the publishing; so they’ll sell half of their publishing to the record company, and retain the other half,” he adds.

The writer keeps all writing rights; so the recent run of artists selling the publishing side of their business for tens of millions of dollars does not necessarily mean they have surrendered all passive income in the future.

“Think of ‘Shark Tank,’” Alexander explains. “When people make a deal with the record companies, they’re saying ‘I will give you X amount of my publishing in lieu of your ability to put my music across the world.’” In certain situations, a rock star will also sell percentages of their writing because it is a separate, and equally tradable, asset.

With a long career, each song can have a different type of deal. These days, a catalog has more value than an individual song because of the growing presence of digital streaming platforms such as Spotify and Pandora, Alexander says.

Disrupting the revenue stream

Music professor Melissa Ferrick says the next frontier in music industry royalties may be micro-royalties for short songs on TikTok. Photo by Matthew Modoono/Northeastern University

“Everybody loves to log on to them and get music for free, but free makes it harder to track who’s playing what” because we are no longer dealing with physical record albums, Alexander says. “Obviously we don’t live in the physical world anymore, so streaming is really affecting things.”

The music industry as a whole has not yet figured out a tracking or compensation system for streamed tunes, making it difficult for up-and-coming artists compared to their more established peers, who have the benefit of a big record deal.

Music professor Melissa Ferrick explains it like this.

“Before digital streaming, people were buying product,” she says.

“Let’s pretend that I wrote a song and Taylor Swift fell in love with it, and she recorded that song. And let’s say this was in 2000, before iTunes and Spotify. That song would go on a compact disc and I would get paid every single time that CD got pressed. If they pressed a million CDs, I would get 0.091 cents a million times, whether those million copies sold or not.”

The process works differently for unknown artists on a major label.

“Say the label presses 250,000 CDs. I get paid for the 250,000 times that they put my song that I’ve written onto that album,” Ferrick says. “The singer gets signed to the record label, but it’s the record label that presses those CDs, so the label gets the money every time a CD is sold. But the label still has to pay everybody who wrote every song.”

Ferrick was one of several plaintiffs in a class-action suit filed a few years ago against Spotify over royalty payments. The streaming service agreed to settle the matter for $43 million.

Just because the suit is over doesn’t mean streaming has made life easier for well-known acts. Listeners are often less inclined to choose a legacy artist’s songs given the huge varieties of new music out there, affecting their bottom line, Alexander says.

“Look at Sting—fifteen years ago he might have been making eight to nine figures a year,” he says. “That’s probably taken a 60% hit. Sting’s $50 million payout is now an $18 million payout. So to the world, he is very rich. But meanwhile, he’s probably figuring out how to keep the lights on.”

That partly explains why some artists are making up lost revenue by selling their catalogs to a publishing empire or Wall Street firm, which view the royalties as a cash cow.

“The stability of the anticipated future royalty streams is really what makes it attractive to investors,” O’Haver says.

What’s next on the horizon for the music industry?

The next likely shoe to drop is the growing presence of so-called micro-royalties on quick-take platforms such as TikTok and Snap, says Ferrick, who has seen the industry evolve since signing her first record deal in the 1990s. Today she records for an independent label, Kill Rock Stars. The thirtieth anniversary of her first album is next year.

“I’m excited about the idea of the minute-and-a-half song coming back,” she says. “It was kind of like that when rock and roll first started. We had real short songs, like a cappella groups singing under the streetlight. That was the era of short, catchy songs.”

Does Ferrick’s vision of the music industry foresee a CD-less world? Hardly.

“I always tell my students ‘Don’t forget about the girl who’s driving home in her car after her shift at a rest stop in Nebraska,’” she says. “And your song is on that CD and she’s crying on the way home because your song is saving her life. When my students say ‘Nobody cares about CDs,’ I’m like ‘That girl in Nebraska cares.’”

For media inquiries, please contact media@northeastern.edu.