He teaches financial literacy to young people, and the lessons transcend money

Based on an enduring promise he made to a brother who died four decades ago, Nicholas Josey is teaching a small classroom of young people how to prepare for a life of financial responsibility.

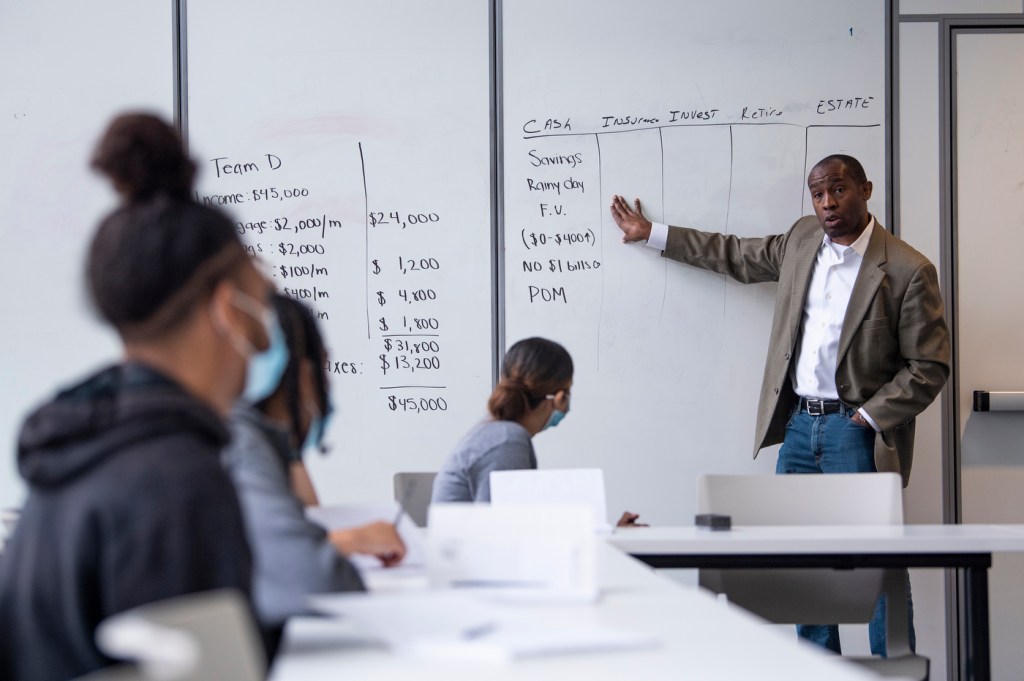

“Who is the most important person in this room?” asks Josey, a 1990 Northeastern graduate who is executive director of the Vincita Institute, a non-profit financial education organization based in Boston. The answer, he says to each student, is you.

Josey wants the students, ages 14 through 19, to assert their own importance—to handle money in ways that will empower them throughout their lives.

Josey left the financial services industry to found the Vincita Institute, which educates and encourages people of all backgrounds to make informed financial decisions. Photo by Alyssa Stone/Northeastern University

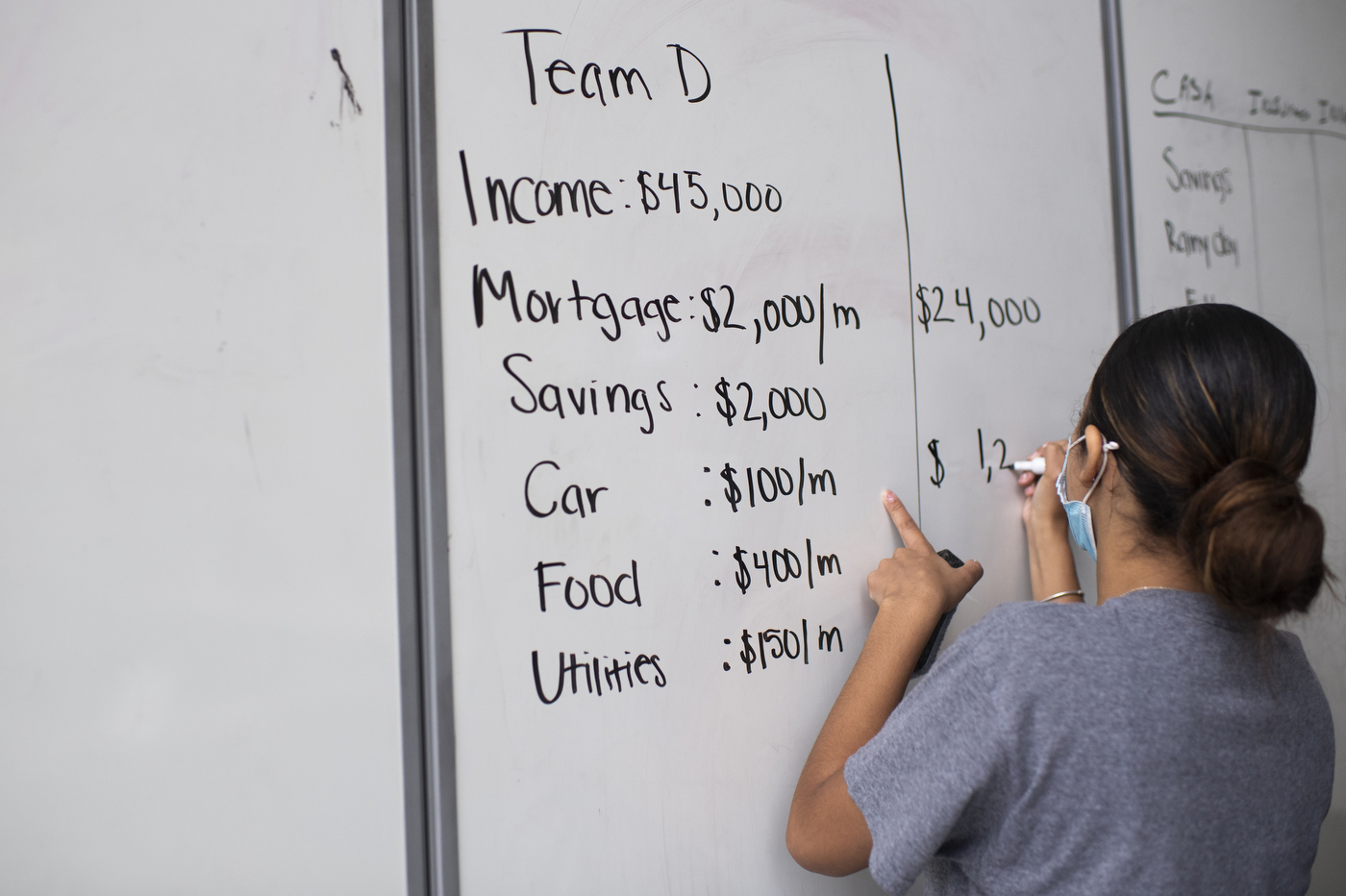

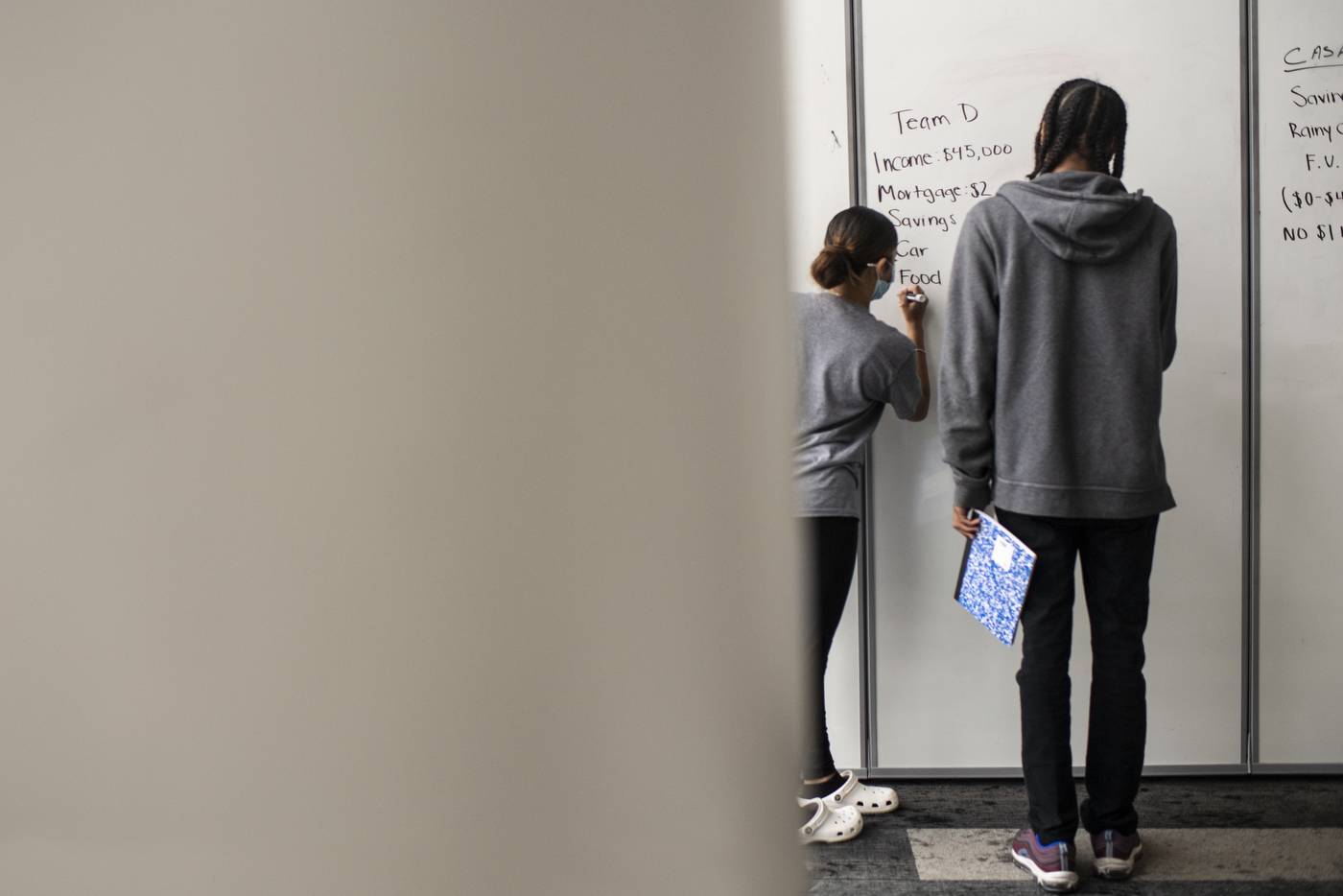

The weekly classes in financial literacy are held at Northeastern Crossing in partnership with Madison Park Development Corporation (MPDC), a 56-year-old nonprofit organization in Roxbury, a community that neighbors Northeastern’s Boston campus. Yhinny Matos, a youth workforce manager at MPDC, recognized the need for a course in financial independence based on a survey of people in the community. Her findings led Matos to create courses that focus on finance, creative industries, health care, law, and construction.

“I called it career path exchange, which are the five basic career paths that the young people were really receptive to,” Matos says. “We were able to implement a lot of different strategies and goals in-person, and I can’t be thankful enough to Northeastern for allowing us to use Northeastern Crossing. It has made [the course] more socially interactive.”

Matos worked with Carl Barrows, director of Northeastern’s Youth Development and Initiative Project. He turned to Josey, who had been working with Northeastern’s City and Community Engagement department for several years.

A 2020 study by the nonprofit Council for Economic Education in New York found that only 21 states require high school students to take a personal finance course, while 25 states require a course in economics, suggesting that many teens must take personal finance education into their own hands.

“Nick is from Northeastern and he has deep roots in our community,” Barrows says. “He wants to see a lot of communities—especially people of color—do well, financially. I’m very big on people from our communities being able to tap into that information, so it was a no-brainer for me.”

A tragic event inspired Josey to help others learn how to help themselves. In 1974, his eldest brother died in a violent incident at age 23.

“I was a military kid in a very large family. I had seven brothers and three sisters, and my oldest brother didn’t make it back home,” Josey says. “My brother was my first superhero. When I grew up and you made a promise to your superhero, you kept that promise.

The students, aged 14 to 19, benefit from Josey’s applications of real-life storytelling that transforms financial issues into personal matters. Photo by Alyssa Stone/Northeastern University

“When he left, I said I was going to somehow make him proud of me. Because my brother died without life insurance, I would find a way to get into an industry to make sure that everyone I came in contact with had some form of life insurance, so that they could properly bury their heroes.”

Josey studied economics and ran track at Northeastern, earning the 1985 New England indoor championship in the 400 meters. He worked in the financial services industry for a decade—selling stocks, bonds, mutual funds, and various forms of insurance—when he made an abrupt career shift.

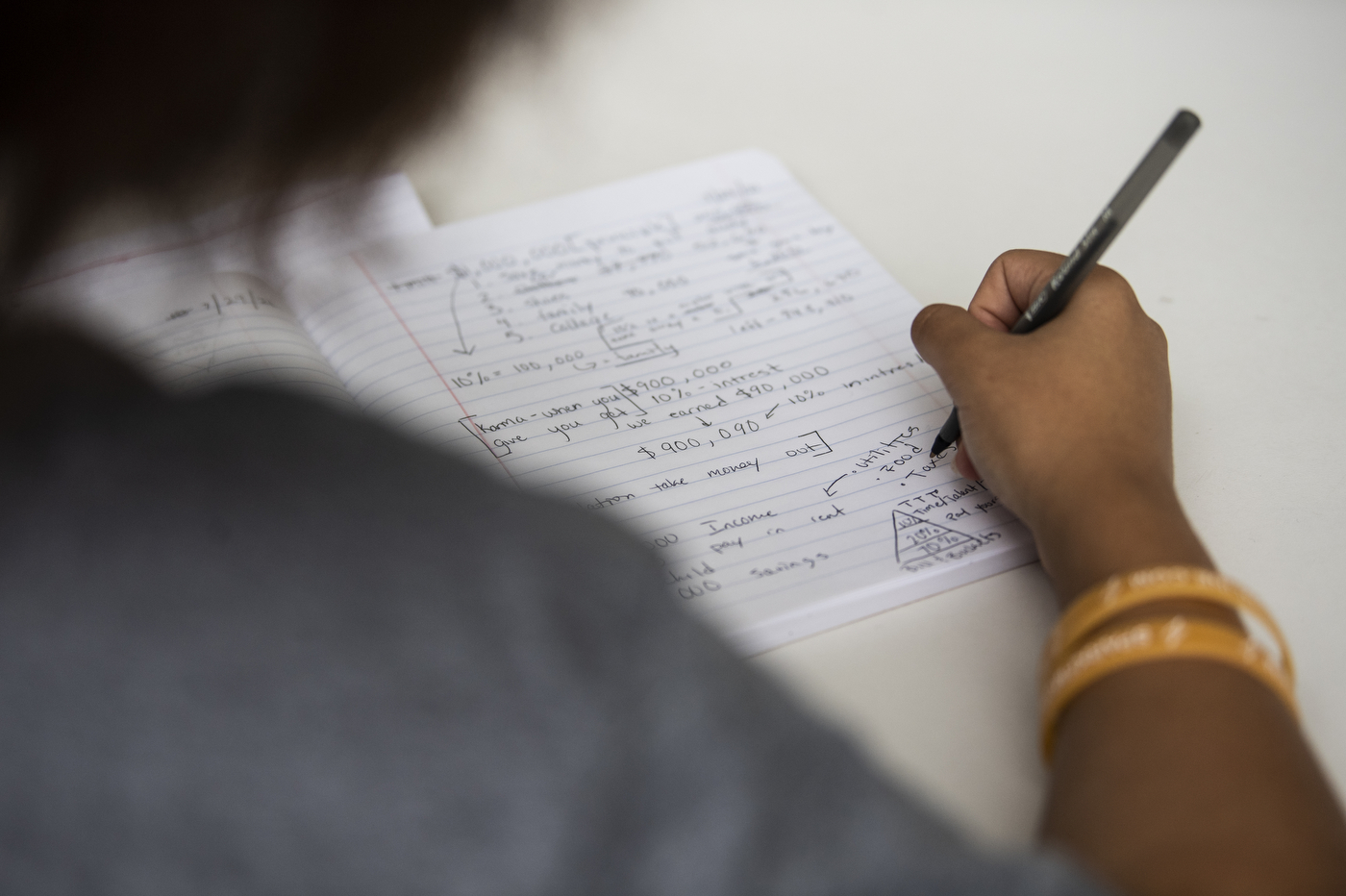

He founded the Vincita Institute to educate and encourage people of all backgrounds to make informed financial decisions—and to prepare for unexpected events. On Thursday morning, Josey asks his students a hypothetical question of what may happen if a household leader fails to return home one day. In response to their silence, Josey turns his back and writes Life insurance on the classroom whiteboard.

“I was traveling around the country and it was great, speaking to large corporations and their employees,” says Josey. “But I found that there’s a lot of people here at home, that if they didn’t work for a good company, they would miss the opportunity to get this information. So I got off the road 17 years ago and started the Vincita Institute. Vincita is the Italian word for ‘victory of the people.’ When you talk about financial things, you want people to be victorious.”

Josey connects the students to fictional adult personas, enabling the young people to experience the financial decisions they’ll soon be responsible for making on an everyday basis. He cracks jokes and applies real-life imagery to transform financial issues into personal matters.

“Who has the purchasing power?” Josey asks the students.

To help them answer that question, he points out that businesses exist at the mercy of customers. Which is why his students should insist on being respected.

“They need you and your purchasing power,” Josey says. “If people aren’t nice to you, you leave and take your purchasing power somewhere else. You don’t have to make a big scene out of it. In 2021, that is your statement: Take your purchasing power to someone who is nice and appreciative to you.”

For media inquiries, please contact media@northeastern.edu.