Prime real estate: Why Amazon is buying Whole Foods

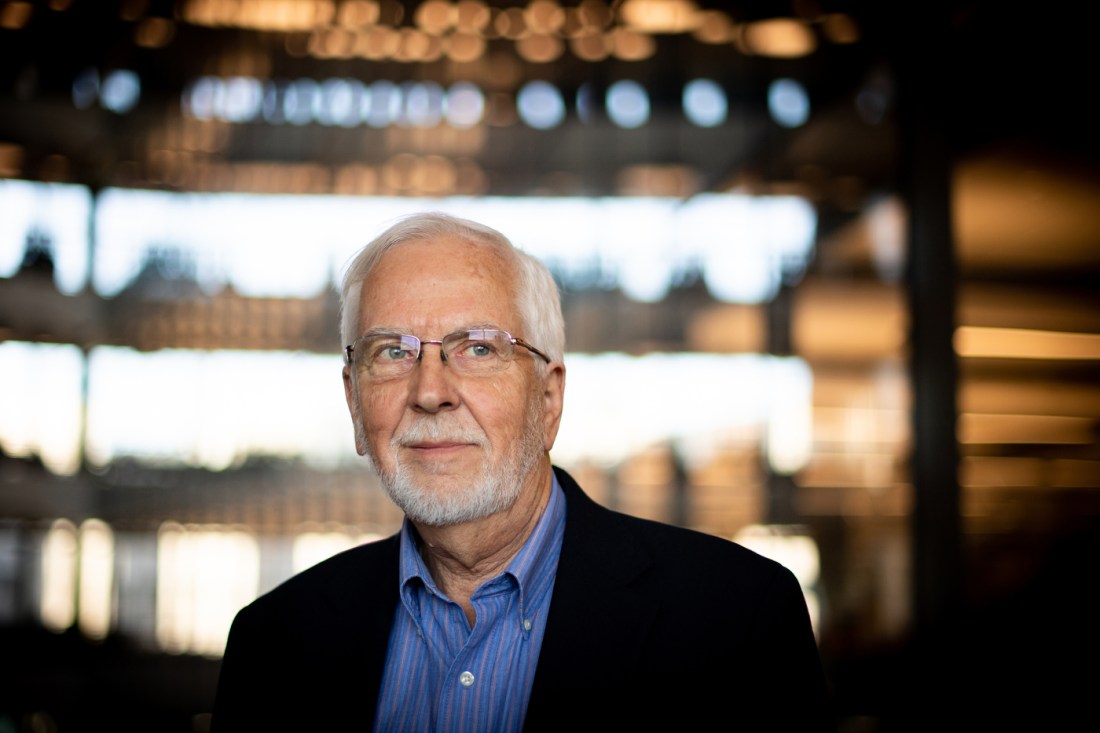

Late last week, Amazon purchased Whole Foods for a staggering $13.7 billion—the largest acquisition ever for the e-commerce company. But why is a company that started out selling books on the cheap now scooping up a grocery chain? We asked John Kwoka, the Neal F. Finnegan Distinguished Professor of Economics, who has written and consulted extensively on issues of market power, mergers, and industrial regulation, to explain the ins and outs of the sale.

First and foremost, why would Amazon purchase Whole Foods?

This gives Amazon the use of hundreds of Whole Foods stores in the right locations to expand its AmazonFresh delivery options for a range of grocery items. So far, AmazonFresh has been something of a nascent operation, but this will afford Amazon lots of exposure in upper-middle class neighborhoods, where people are not only used to paying premium prices for groceries, but are also used to shopping online. This is also an opportunity for Amazon to essentially overlay its distribution system in these existing brick-and-mortar locations.

It’s also an opportunity for Amazon to experiment with check-out options. It has a store in Seattle, Amazon Go, which allows customers to pick up groceries and walk out without waiting in a check-out line, because the items are charged to their Amazon Prime account. You could see a situation in which Amazon might experiment with these types of options at Whole Foods, as well.

The thing is, though, Amazon is famous for being a creative company. It has a lot of intellectual firepower and enormous capital behind it. Purchasing Whole Foods wouldn’t have been anyone’s prediction, so there’s also the question of, can we really predict what it will be doing with the Whole Foods stores? Nobody is ever quite sure what Amazon is up to, but one thing remains generally true: retailers don’t like Amazon in their spaces, but customers do.

What, then, is the benefit for Whole Foods?

Whole Foods’ growth has slowed markedly in the past few years, because everyone else is selling the same stuff now. The company was first in this organic, health foods space, and it dominated that space for 10 years or so. It revolutionized how people thought about organic foods, but it’s not like everybody else stood still during that time.

Wall Street has been looking for it to find new avenues of growth, because the old one is tapped out. But what is it that Whole Foods can do that’s different, but would still make sense for the brand? I think the company has been hard-pressed to figure that out. It would be easy to believe that this is a company whose heyday has passed, and it seems pretty clear that if it had a better idea, it would have done it. If the board at Whole Foods knew another way to trigger a landslide of business, they would have done it.

You mentioned consumers earlier. How might they benefit from this sale?

As with most things Amazon does, there are two sides to this story. The upside is, convenience and low prices are huge advantages that Amazon has with consumers. The downside is that it has so many products under its roof, it makes people uneasy—there’s an ability to control choice.

If a small vendor or an upstart wants to get access to consumers, Amazon is the default way to do that. That’s something the vendor may or may not want to do.

Amazon has a startling array of stuff. This is a company that used to sell books cheaply, and it’s unrecognizable now. So, there’s a lot of anxiety about the power of control and the discretion over the marketplace that companies like Amazon and other big tech companies have.

Given Amazon’s breadth, does its merger with Whole Foods come close to violating any antitrust laws?

Antitrust agencies look at competition—or lack thereof—in determining whether there is an antitrust violation. So, in this sense, does it raise any antitrust questions? The answer is almost certainly no. Amazon isn’t really much in the grocery business, so the overlap with Whole Foods is minuscule and unlikely to raise any antitrust concern.

Amazon does raise a lot of questions beyond immediate competition, though. Somebody looking into existing overlap may overlook something important, and that’s the elimination of potential competition.

Let’s say, for instance, that a company like Amazon weren’t allowed to purchase a company like Whole Foods for antitrust reasons. Might it be the case that Amazon would get into the grocery field itself? And if it did, wouldn’t that introduce a new competitor in the future? That might arguably be a better resolution, as a new competitor—doing innovative things in order to compete—would be introduced rather than potential competition being eliminated. However, antitrust agencies don’t look much at that, because it’s largely speculative.