Northeastern launches loan program for women and minority entrepreneurs

Northeastern University announced on Tuesday that it will launch the region’s first university-supported loan program for women- and minority-owned businesses. The initiative, called the Impact Lending program, will enable local small-business owners to secure loans, at below-market interest rates, to acquire crucial resources to expand their businesses.

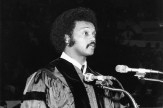

The program was unveiled by Northeastern President Joseph E. Aoun and Boston Mayor Marty Walsh at an event at the Bolling Building in Roxbury.

“Boston is home to a diverse network of entrepreneurs and small business owners,” said Mayor Martin J. Walsh. “Ensuring that these local small businesses are able to expand will contribute to Boston’s economic growth. Diversity is key to our city’s success, and I’m proud to support Northeastern and LISC in the Impact Lending program.”

Ensuring that these local small businesses are able to expand will contribute to Boston’s economic growth. Diversity is key to our city’s success, and I’m proud to support Northeastern and LISC in the Impact Lending program.

— Boston Mayor Martin J. Walsh

Northeastern has committed $2.5 million in seed funding to the program, which will allow for a revolving fund of $6.5 million in loans. The university has partnered with Local Initiatives Support Corporation, a nonprofit that provides loans and advisory services to underserved small businesses. LISC will administer and oversee the loans, ranging from $1,000 to $1 million, with Northeastern’s seed funding serving as a guarantee.

“An entrepreneurial ecosystem must embrace innovation and support those who are one opportunity away from turning ideas and hard work into prosperity,” Aoun said. “It is part of Northeastern’s ethos to invest in innovation and celebrate the entrepreneurial spirit both within our own community and through our partnerships with the communities around us.”

The loans can be used for a variety of business needs, including hiring new staff, obtaining new equipment and facilities, and purchasing inventory.

The goal of the program is to serve 85 small businesses and create 330 jobs in the first two years. In addition to helping businesses grow, the program will also allow for these businesses to compete for larger contracts with the university.

It is part of Northeastern’s ethos to invest in innovation and celebrate the entrepreneurial spirit both within our own community and through our partnerships with the communities around us.

— Northeastern President Joseph E. Aoun

LISC will also provide advisory services to help the businesses navigate the financial and contractual opportunities available to them, scale up to take on new opportunities, and address other business issues to ensure that entrepreneurs will be successful.

“Not everyone has benefitted equally from the recent economic upturn,” said Bob Van Meter, LISC Boston executive director. “Our goal is to connect small businesses from low-income neighborhoods with the broader regional economy. In building up their capacity, local businesses will be able to take advantage of opportunities for business growth that were previously unavailable to them.”

The Impact Lending program, which is now accepting applications, is the latest example of Northeastern’s close partnership with the city and the region, work that includes scholarships that support local youth, investments in city-owned parks and community spaces, community-based programs, and volunteer service work.

Last fall, the university opened Northeastern Crossing, a formal venue dedicated to fostering dialogue, creative collaboration, and new connections between city residents and Northeastern faculty, staff, and students.