Published on

Human cost of large-scale acquisitions. How a professor turned decades of research into US antitrust policy

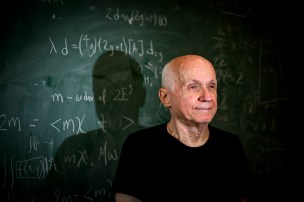

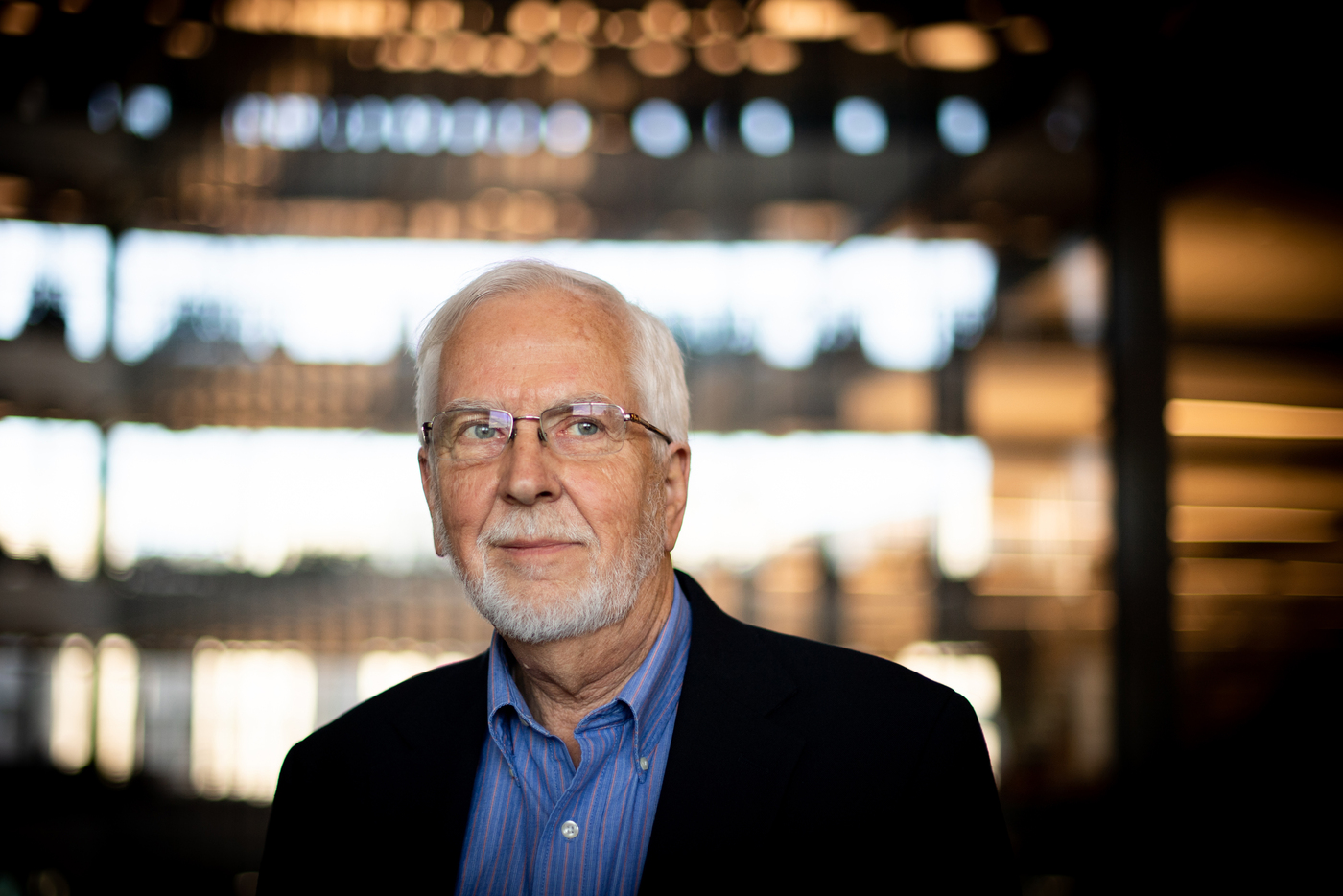

For more than four decades John Kwoka has argued that American competitiveness and U.S. workers were suffering as power was consolidated among a smaller number of companies that had been permitted to grow ever larger.

What should happen if a major tech company is taken over by an unreliable CEO?

“Say it’s a person who is unpredictable,” says John Kwoka, the Neal F. Finnegan Distinguished Professor of Economics at Northeastern. “Someone who may be smarter than others but doesn’t view his mandate as limited to the sort of things that serious business people do.”

Someone like Elon Musk, for example?

Kwoka nods and says, “We’ve watched with some alarm how a person can take over a $50 billion business, treat it as a toy, firing two-thirds of the employees and turning it into something altogether different without needing to care very much because he’s worth half a trillion dollars.”

Kwoka is referring to Musk’s controversial $44 billion acquisition of Twitter, which has lost more than half of its advertising revenue amid a rebrand to its new name, X.

“It’s the sort of thing that is now possible,” Kwoka says of the wide range of issues posed by tech behemoths — including multinationals like Apple, Alphabet/Google and Meta/Facebook — that have taken on unprecedented influence with relatively little public oversight. “And that’s a concern.”

Kwoka has focused his academic life on issues of mergers and antitrust. For more than four decades he argued that American competitiveness and U.S. workers were suffering as power was consolidated among a smaller number of companies that had been permitted to grow ever larger.

“Nobody knew what it was about or why they should be interested in it,” he says of his concerns for the people and industries hurt by the bigger-is-better approach to business. “It was a losing battle.”

Then Kwoka recognized a promising shift. In 2021, he took a call from Lina Khan, the newly confirmed chair of the Federal Trade Commission. She was asking if Kwoka would be interested in serving as one of her top advisers with the title of chief economist to the chair as the FTC set out to update its guidelines on mergers to account for new issues raised by tech companies and other conglomerates.

At long last Kwoka sensed that the conversation around mergers and acquisitions had evolved beyond the narrow financial concerns. The social consequences were now being raised. And he found himself in the middle of the policy debate.

“This is a moment,” says Kwoka as he looks back on his year contributing to the revised antitrust policies that have emerged recently from Washington. “There are new people doing new things and I’m very pleased that I’ve had an opportunity to be there for it.”

The wider economic costs

Kwoka has seen the pendulum swing both ways. At the beginning of his academic career, the FTC tended to apply more stringent standards to acquisitions with a focus on preventing monopolies.

“In the ’60s and ’70s, lots of mergers were prevented,” Kwoka says. “And some of those decisions were probably not such a great idea. They gave antitrust [proponents] a bad reputation for being thoughtless — for not being interested in thinking more broadly about the full effects of preventing mergers.”

The influential teachings of Robert Bork created momentum for the emerging point of view that large mergers created efficiencies and cost-savings that outweighed any potential harm that was being inflicted on competitiveness. Since the 1980s administration of President Ronald Reagan, notes Kwoka, far too many mergers have been allowed with little to no government opposition.

As the rich have grown richer, a theme of Kwoka’s work has been to consider not just the supposed benefits but also the human cost of large-scale acquisitions. His point of view has been influenced to a personal degree by the experience of his father, who worked in the Western Massachusetts factory of a machine tool company that was acquired in the 1980s by the conglomerate Gulf and Western.

The acquisition and shutdown of his father’s company was part of the new era of consolidations.

“They promptly shut the thing down because it wasn’t of interest to them,” Kwoka says of his father’s company, Van Norman Industries, which had been absorbed by Gulf and Western as part of a larger acquisition. “My father ended up at a middle-to-advanced age with a trivial pension and no job in a market that wasn’t all that favorable.”

Kwoka says such acquisitions led to the demise of the machine tool industry throughout the U.S.

“I don’t want to say that I’ve spent my lifetime working on these issues because I’m ticked off at something that happened to my father generations ago, but it is a telling example,” Kwoka says. “The acquisition and termination of a company like that costs workers and communities. It also has wider economic costs.”

Countless industries have undergone massive consolidations over the past 15 years, Kwoka’s research has found. He says these consolidations have led to drastic losses of competition, especially in the burgeoning tech world that has come to be dominated by Apple, Alphabet/Google, Amazon, Meta/Facebook and Microsoft.

“The five major tech companies have acquired more than 900 companies in the last 20 years,” Kwoka says. “And up until two years ago, there wasn’t a single challenge — or even a serious investigation — of one of them.”

Kwoka believes major parts of the five conglomerates should probably be split off to renew American competitiveness in the tech industry and beyond.

“A lot of those acquisitions are perfectly harmless,” Kwoka adds. “But we now know that many of them were not. And there was no serious scrutiny.”

Kwoka is an internationally recognized expert on antitrust and competition policy, says Robert Triest, chair and professor of economics at Northeastern.

“He’s certainly very reasoned in his analysis and bases it on good fundamental economics rather than on ideology,” says Triest, a former vice president and economist at the Federal Reserve Bank of Boston. “His view that we need more active competition policy is one of the things that made him an attractive candidate to be an adviser to Lina Khan at the FTC.”

‘It’s hard to turn down’

Kwoka, who came to Northeastern in 2001 after two decades as an economics professor at George Washington University, began altering his approach to mergers a decade ago.

“I decided that looking at individual cases was not the way to do this,” Kwoka says. “So I spent quite a long time with a couple of Ph.D. students compiling all that we knew from careful economic studies of 60 to 65 mergers.”

His 2020 book, “Controlling Mergers and Market Power: A Program for Reviving Antitrust in America,” laid out the bigger picture.

“My book explained that about 80% of these mergers turned out to be anti-competitive because they resulted in price increases,” Kwoka says. “Every one of them had been reviewed by one of the antitrust agencies and approved. It showed that the agencies, despite all their efforts, and sometimes maybe not making as much effort as they should, have approved more mergers than they should.”

Bill Baer, a visiting fellow at the Brookings Institute, lauded the book as “a powerful call for action.” Barry Lynn, executive director of the Open Markets Institute, referred to Kwoka as “the rare economist who understands that the purpose of antimonopoly law is to protect our democracy and to make every individual more free, more secure and more prosperous.”

“It sets out a comprehensive program for expanding merger enforcement to stop the inevitable consolidation that has occurred over the past 30 to 40 years,” Steven Salop, a Georgetown professor of economics and law, said of “Controlling Mergers and Market Power.” “I hope that enforcers read Kwoka’s book and take it to heart.”

Khan appeared to do just that. She called Kwoka to ask if he was interested in working with her in Washington.

“I didn’t have to think very hard to say yes,” Kwoka says. “I teach, I research, I lecture, I do some advising. But at the end of the day if someone asks, ‘Do you want to sit at the table where you can actually write the damn stuff down? And maybe change the way we think about some of this stuff?’ It’s hard to turn down.”

‘The good fight’

Kwoka’s one-year term with the FTC began in January 2022. He was given a Washington office down the hall from Khan’s. But he rarely used it.

“The agency didn’t close the doors, but they discouraged people from coming in,” Kwoka says of the COVID-19 protocols of that time. “I had intended to commute to Washington for two or three days every couple of weeks, or whatever was necessary. But when I went down there, the headquarters building was a ghost town.”

Kwoka worked mainly from his home in suburban Boston. He maintained his weekly one-on-one meetings with Khan via Zoom. There were many late nights as he contributed to the FTC’s efforts to revise its comprehensive guidelines on mergers.

Despite the hassles and frustrations of working virtually, Kwoka was invigorated by the mission. Khan wanted to update the U.S. merger guidelines to account for the effect on wages and other worker issues. She was concerned with the kinds of vertical acquisitions that have become common in health care as hospitals have acquired physician groups.

There was also the broader concern of Americans finding themselves at the mercy of tech CEOs who have taken on extraordinary power in the marketplace.

In short, she was expanding the focus on financial consequences to include the effects of large-scale mergers on workers and people across the economic spectrum.

In July, seven months after Kwoka’s term ended, a draft of the new guidelines was presented jointly by the FTC and the Department of Justice — representing another point of view that competitiveness issues transcend the scope of the FTC.

The draft addresses Khan’s areas of focus, including acquisitions that are aimed at sidelining potential competitors that might grow into serious rivals to the dominant companies.

“The guidelines are an effort to explain how U.S. agencies think about mergers,” Kwoka says. “They are published to help companies and their law firms understand the problems that may arise from particular mergers.

“The guidelines also help explain to the judiciary [branch] how the agencies analyze mergers. They don’t tell the judges how they should rule. But it does explain in some detail how to think about the effect of mergers — and how the agencies predict or anticipate some particular types of mergers that have anti-competitive effects.”

For the first time, Khan has instituted an ongoing 60-day window of public comment that has allowed people throughout the U.S. to weigh in on the effects of conglomeration.

“The listening sessions are focused on different sectors of the economy — agriculture, biotech, that sort of thing,” Kwoka says. “I’ve listened to hospital staff explaining what happens in the process of a health care acquisition or private equity takeover. Not only do dedicated people lose their jobs, but they see the ability to provide high-quality service to patients deteriorate. It is sad and familiar.”

Kwoka has wasted no time passing on his experiences. In January, shortly after ending his tenure as FTC chief economist, he began teaching a new undergraduate course at Northeastern on antitrust economics.

“I thought it was an extraordinary experience to pivot within a few days,” he says. “To be talking to our students here about the way the sausage was actually made.”

His time with the FTC has renewed Kwoka’s mission to explore how a growing American economy can help people.

“These people are not about to abandon the fight,” he says of his former colleagues at the FTC. “That’s why I signed up. Because it really is a moment. I don’t want to over-dramatize this, but it’s a moment that I haven’t seen in my long career where people are determined to go out there and fight the good fight on some things that need to be fought.”

Ian Thomsen is a Northeastern Global News reporter. Email him at i.thomsen@northeastern.edu. Follow him on Twitter @IanatNU.